As a provider of inflight connectivity system integration components, antenna radomes and satcom aircraft equipment kits, as well as aircraft cable and wiring products, Carlisle Interconnect Technologies (CarlisleIT) holds an interesting position in the market.

As a provider of inflight connectivity system integration components, antenna radomes and satcom aircraft equipment kits, as well as aircraft cable and wiring products, Carlisle Interconnect Technologies (CarlisleIT) holds an interesting position in the market.

From its vantage point, the firm — which boasts three decades worth of experience in developing modification packages and Supplemental Type Certificates in aviation — has a strong sense about what IFC work is in the pipeline and what nextgen solutions are ready for primetime, and can quickly assess emerging trends.

Runway Girl Network interviewed company director of product management, integrated products Jeff Behlendorf to understand the latest state of play for CarlisleIT, and the broader IFC industry as aviation gradually emerges from the COVID-19 crisis.

RGN: When inflight connectivity performs poorly, it is often assumed that the problem stems from either a software or antenna hardware problem. But every aspect of an IFC system needs to be in working order, including the wires and cables. As airlines adopt next generation IFC solutions, what should they be thinking about when it comes to interconnect solutions? What products in CarlisleIT’s portfolio would be considered “top of the line” and ensure that every aspect of onboard data transmission is top notch and meets the client’s expectations?

Jeff Behlendorf: Obviously, we put a lot of focus on the antennas, modems, amplifiers and access points, but at the end of the day they don’t work unless you’ve got them connected to each other. So, we spend a lot of time, energy and lab money making sure we are providing ruggedized cable and wiring solutions. Today, we’d tell people, as connectivity speeds go up, one thing everyone needs is headroom — i.e. enough space and data pipe to handle all of the demand, and the demand is not always uniform. The cabin is noisy. There are a lot of devices, and a lot going on creating radio noise in this big aluminum tube flying in the air. Carlisle does a lot of fiber optic solutions, and we’re seeing a lot more exploring of optical cables to go between critical devices. We offer a whole family of those cables and connectors under the LITEflight series. We are seeing growing interest in 10 gigabit copper data pipes as well. Carlisle offers the Gigabit-10HP series cables for these applications. They have a different construction to make them resistant to interference. We’ve tested them pretty reliably to 300ft or further, even in the noisy space. And then in the business aviation side, we’re seeing a lot of demand for 4K HDMI cables. HDMI products are targeted at business jets for those who want the big displays, the more conventional consumer electronics on board their business jets. In commercial aviation, we’re really focused on high-speed data and a lot of times, the airlines are overlapping a connectivity solution with onboard IFE and they’re pushing a lot of bits around to get everyone streaming.

RGN: Appreciating that CarlisleIT has many partners in the IFEC world, does CarlisleIT go direct to airlines with its interconnect solutions to help solve their problems with legacy kit, or does it usually work with the aero ISP? Both?

Behlendorf: Both is the answer. CarlisleIT serves all levels of the aerospace market — the ISP; the end user which is the operator; all the way to the third or fourth supplier providing subsystems or components. Most things involving onboard connectivity go through the ISP, almost always. Airlines want one ultimate service provider, and the ISP comes to CarlisleIT and we address the problem either from our portfolio or we develop custom solutions. It’s not unusual for CarlisleIT to develop a custom cable construction or connector solution that helps them get past their technical challenge.

RGN: What type of post-delivery maintenance program is offered, and is this packaged into CarlisleIT’s offerings?

Behlendorf: It depends on what we’re selling. A large percentage of our parts are designed to be maintenance free, designed to fly for 50 years without being touched. For the most part, a lot of the maintenance is done on the line, so usually it’s just providing maintenance instructions, spare parts as needed and we support them doing their own repairs. In some cases, we do provide rotable exchange programs with the factory. We take things back off the aircraft and refurbish them, which is usually done with an MRO or airline where they have a lot of equipment and need to have spares in circulation.

RGN: We’re seeing a number of new IFC technologies arrive on the scene, including electronically steerable antennas, hybrid electrical mechanical steered antennas, and nextgen ATG antennas. What interconnect solutions make the most sense for each of these?

Behlendorf: It would be nice if there was a one-size-fits-all solution, but especially as we look at hybrid electronically steered antennas and other technically different solutions, we’re seeing a lot of divergence in the marketplace; people are going down a lot of different paths. Amplifiers and frequency block converters are ending up in the antenna package rather than as separate boxes. That’s reducing the cabling. So, that’s coming out of the installation and going into the package electronically. But we’re also seeing more demand for high-data solutions so once again we’re back to fiber optics and 10 gigabit copper. Some connectors are needed to get through the bulkhead, but we’re mostly seeing a trend towards more data cables and less RF cables.

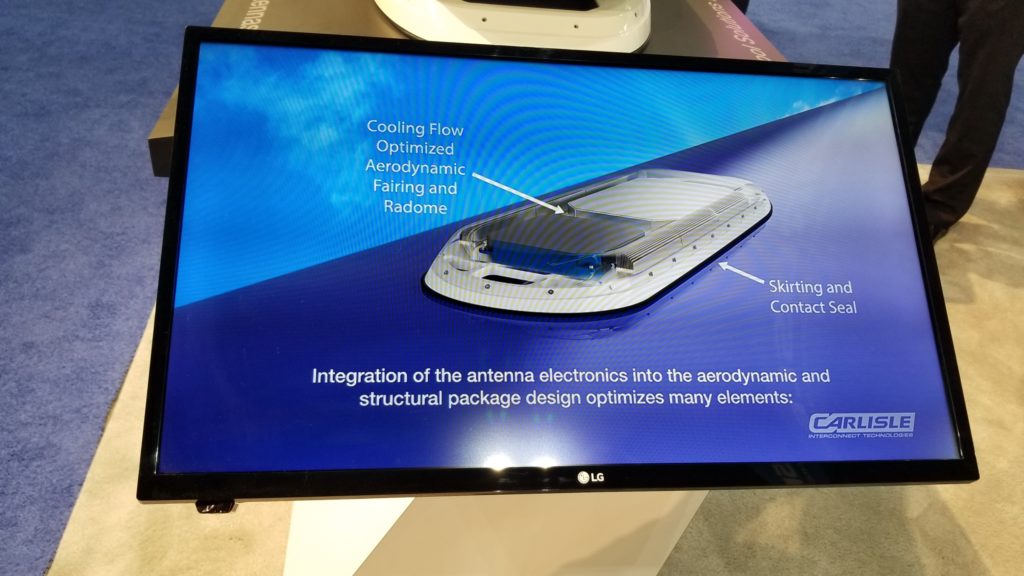

RGN: CarlisleIT showcased an intriguing ESA cooling system a few years ago; now that ESAs are seeing more interest and LEO constellations are being built out, has CarlisleIT entered any interesting discussions with potential customers? What type of market are you targeting for this solution?

Behlendorf: So, we actually have more than half a dozen antenna makers that we have regular conversations with. The truth is ESAs are still an R&D project still adapting to commercial aircraft applications. A lot of people have ground demonstrators that prove the technology works, but not a ready to fly antenna package. In the meantime, when those technologies need a lot of cooling — and we need to get that heat out of that antenna — we’re offering that type of technology to do an integration. We have always focused that product on regional jets and smaller aircraft because we think it’s going to be necessary to make those aircraft viable in a satcom scenario. You’ll need some kind of ESA. Obviously it would scale up to larger aircraft, but as the plane gets bigger, the amount of systems that look attractive get more complex. There are a lot of choices available, and we really don’t see that settled out as yet in terms of technology of choice.

We certainly pay attention to who is winning and losing the antenna race, which ones are coming off and going on. Right now, I’d say the gimbaled antenna is still king. It is still what everybody is putting on the aircraft, but certainly the wind is blowing the other direction. There is are a lot of discussion about hybrids – mechanically steered and electronic. What ThinKom provides; those are still popular. There are a couple antenna makers building systems like that. And a lot like the EAN that Inmarsat operates in Europe [hybrid S-band/ATG], which is flying with British airways and which BA says it’s very happy with. We know that the Gogo AVANCE system, which is targeted at business aviation, is a hybrid. You can have a satcom and ground component together and see a cost-of-service advantage by going to a lower-cost service where available. And obviously we see plenty of people doing demonstration applications where they’re jumping back and forth between LEO and GEO satellites. Global Eagle did demonstration flights showing they could hand off seamlessly back and forth. Hybrids are probably inevitable.

We certainly pay attention to who is winning and losing the antenna race, which ones are coming off and going on. Right now, I’d say the gimbaled antenna is still king. It is still what everybody is putting on the aircraft, but certainly the wind is blowing the other direction. There is are a lot of discussion about hybrids – mechanically steered and electronic. What ThinKom provides; those are still popular. There are a couple antenna makers building systems like that. And a lot like the EAN that Inmarsat operates in Europe [hybrid S-band/ATG], which is flying with British airways and which BA says it’s very happy with. We know that the Gogo AVANCE system, which is targeted at business aviation, is a hybrid. You can have a satcom and ground component together and see a cost-of-service advantage by going to a lower-cost service where available. And obviously we see plenty of people doing demonstration applications where they’re jumping back and forth between LEO and GEO satellites. Global Eagle did demonstration flights showing they could hand off seamlessly back and forth. Hybrids are probably inevitable.

RGN: In CarlisleIT’s opinion, how do nextgen ATG systems compare to satellite solutions, and what are the prospects for meaningful hybrid ATG/LEO, hybrid ATG/GEO, hybrid LEO/GEO (and MEO) solutions coming to market? Is CarlisleIT working with partners in these areas and in what capacity (that it can discuss)?

Behlendorf: Ground solutions always have had a fundamental advantage in terms of cost. Their towers are closer [to the aircraft than satellites] and it’s easier to get to the ground tower. The downside is they only work where you have a tower network. You’ve heard of the famous Montana gap, where connectivity gets weak with the lack of ground solutions. We see a lot of people working ground networks. We see the EAN, plus SmartSky overlapping Gogo’s network substantially across the country. We see several players talking in China about domestic use. We know of at least one ground network being built in New Zealand for their domestic fleet operation. So, it’s clear that the economics look good. They’re inexpensive to operate and easy to maintain. You need a lot of towers, but they’re inexpensive compared to putting up satellites. SmartSky uses a 4.5G type of hybrid. They offer a lot of advantages in terms of data rates, especially for aircraft which spend all their time over land. I believe they will be competitive to Gogo. They’ll find a market for it and definitely find customers who want a more cost-efficient air-to-ground connectivity solution. LEOs are coming but are not ready yet. 5G will beat them! It’s a question of who makes the switch and who waits. Connectivity is the cost of doing business, especially in western markets today. There is an expectation that you can get connected on your plane.

RGN: CarlisleIT is known as an expert in the system certification arena, with a cadre of STCs for IFC and other avionics systems. Is the company developing any new STCs to meet the needs of the changing environment (aforementioned nextgen ATG, LEO, hybrids etc)?

Behlendorf: All of the STC work we’re currently doing is still using either a traditional gimballed antenna type of solution or something like a hybrid, a ThinKom-style antenna. We have not yet seen any real commitments to a fleet-scale LEO program, where we’d have ESAs over a large portion of aircraft. But generally speaking, the LEO constellations aren’t ready yet. They’re not in full blown buildout; and most who are launching LEO satellites are focused on terrestrial customers. Aircraft will come second. Their energy is focused on getting their ground stations up and running. They keep telling us aircraft are coming but it’s second to terrestrial. The business case for a LEO network is not based on aircraft. It’s based on the ground applications.

RGN: COVID-19 obviously has been extremely difficult for aviation. But one thing we’ve observed is that IFC, especially, has become the cost of doing business, especially for narrowbody and widebody operators (and indeed some regional jets). People expect to be connected. As industry recovers, what types of trends is CarlisleIT observing? And what role will CarlisleIT play in recovery, as airlines get connected (interconnect solutions, adapter plates/radomes, other hardware, certification, etc)?

Behlendorf: I do think that the way we’ve used the data connections have changed. Everyone just needs to pick up their smart phone. It can be everything, including an online gaming device. You can even play Fortnite on your phone. And people have kind of taken that entertainment on board. People get their music through Spotify and enjoy that the catalogue is basically bottomless, is on-demand, and you can get whatever you want. Those trends are driving the expectations on board because you don’t think about changing your habits just as you get on a flight. So that’s driving that expectation for inflight connectivity. It is making it certainly something that aircraft operators are cognizant of the fact it’s no longer a luxury.

As industry emerges from the COVID-19 crisis, business is picking up a bit. Obviously, last year shell shocked everybody. There was a massive drop in retrofit activity and deliveries almost stopped but we haven’t seen it completely stop ever. It slowed dramatically. There are a lot of signs in the first half of this year that it’s picking up again. One thing we are seeing is a lot of operators are making the decision to retire certain fleets. They have the opportunity to reshuffle their fleets, which is driving cancellations of retrofit programs, and replacing them with linefit programs with aircraft coming new from Boeing and Airbus with IFC already provisioned. It alters our mix a little bit and changes our delivery pattern. Carlisle provides a lot of radomes and adapter plates to Airbus linefit. For Boeing, we provide a lot of products for connectivity though it isn’t radomes; mostly we’re providing Boeing with cabling and wire provisions.

Boeing provides a tri-band radome with IFC installs. Tri-band has been a compromise — it comes with all the benefits of being a Boeing solution in terms of maintenance support and spares, but I think there are several providers that consider it a compromise and feel they are not getting the best out of that install.

In terms of future technologies, we certainly know that they’re not super excited about developing five or six radomes for five or six antenna technologies. But we also think there will be a market dynamic change. It’s not going to be as much of a one-size-fits all solution. I think they already recognize they’ll need more flexibility for future hybrids, ESAs, etc. They’ll take Boeing’s path, but we think there will be more diversity in the catalogue.

More broadly, in terms of deal making, we’ve seen a lot of people retooling their offerings over the last year. We’ve seen people re-packaging electronics, there have been new antennas and modems, industry consolidation with Intelsat acquiring Gogo, which changes their place in the market a little bit. The market is evolving for sure from a big market downturn. But it forces a lot of decisions to be made and I think that will revitalize a lot going forward. There is a whole new generation of stuff to do.

Related Articles:

- CarlisleIT supports Chinese satcom projects as market heats up

- China’s APSATCOM mulls new HTS with capacity targeted at IFC

- ZTE Corporation talks 5G ATG inflight connectivity for China

- Gogo Business Aviation progresses with 5G ATG; eyes hybrid ATG/LEO

- ThinKom sees Ka antenna as uniquely positioned to meet new WRC rules

- Gore sees opportunity to grow fiber optic cable business in aviation

- CarlisleIT grows portfolio of STCs for GX inflight connectivity

- OneWeb taps SatixFy multi-orbit terminal for inflight connectivity

- ESA adoption in commercial aviation could take years

- CarlisleIT looks to IAMA to help address three big STC challenges

- Telesat to forge multiple aero antenna partnerships for Lightspeed

All images credited to Becca Alkema