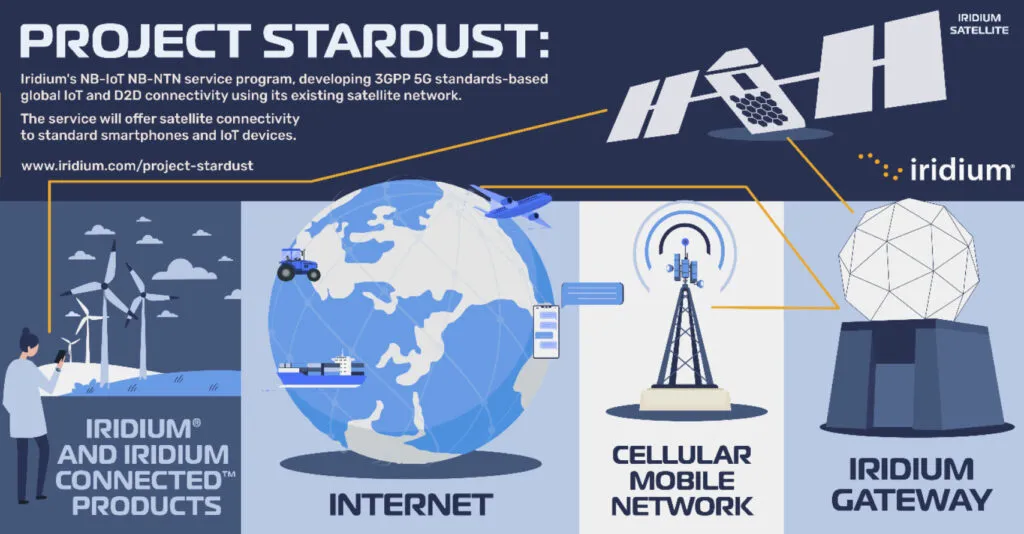

Eager to crack into the burgeoning direct-to-device satellite connectivity market, Iridium recently revealed it is designing a 3GPP 5G standards-based narrowband-internet of things (NB-IoT) service to initially support messaging and SOS capabilities for smartphones, tablets, cars, and other related consumer applications over its global LEO network.

The so-called Project Stardust endeavor addresses one of the key learnings to emerge from Iridium’s collapsed deal with Qualcomm — which would have seen it deliver a proprietary direct-to-device (D2D) solution on Android smartphones — and that is that smartphone makers are looking for standards-based solutions.

By taking advantage of existing mobile standards, Iridium says it can offer “both high-quality proprietary and standardized D2D and IoT services to its customers”. It has invited smartphone vendors, OEMs, chipmakers, mobile network operators and IoT developers “to have their requirements woven into the fabric of the Iridium network” and says it’s already collaborating with several of them. Testing will begin in 2025.

The Project Stardust announcement comes at a time when Iridium is seeing strong momentum in aviation and is poised to go further, given that Certus-powered safety services are forthcoming. But if a meaningful number of cellular stakeholders take Iridium up on its offer, would that impinge on the capacity available in aero and indeed other mobility verticals?

For context, last year during an APEX TECH conference session that included another D2D innovator, SpaceX, and which was moderated by yours truly, Neale Faulkner — then a regional VP for Inmarsat, and now a regional VP at Inmarsat’s acquirer, Viasat — suggested that D2D would be a disruptor in aviation connectivity “in that it will be consuming a huge amount of capacity.”

“So,” he continued, “as Inmarsat we focus on mobility, only mobility and so services like aviation, maritime, etc. I think you know with 5G backhaul, direct-to-device, terrestrial services, the glut of capacity that is going to come across is going to be utilized by a lot of different services and direct-to-device is going to be one of those. And so, for some services it’s going to have a negative impact on what you can do on an aircraft, right. That’s my view.”

During Iridium’s Project Stardust press conference, company CEO Matt Desch said: “We believe this is an incremental opportunity on top of our already growing and thriving business.” And this is, after all, a narrowband service (it’s not seeking to support browsing.) But following the presser, RGN asked Desch to share Iridium’s message to the aviation community in terms of the firm’s commitment to the space and its room to grow.

Agreeing that Iridium is “positioned well to really expand our aviation business this year” and expressing his excitement about that prospect, Desch said via an emailed statement that:

Stardust is very consumer product and IoT based, so don’t see any conflict there or how this takes away from our expanding business in aviation. We already support cockpit messaging, and have partners looking at using higher speed Certus midband and broadband for cabin services. I’m not sure that a standards-based messaging service adds much — Stardust is really targeted at embedding Iridium messaging into smartphones directly that would otherwise use a standard processor anyway — i.e, at little incremental cost.

He added in a follow-up that: “Project Stardust doesn’t do anything Iridium SBD [short burst data] doesn’t – it just incorporates it into an existing standards-based chipset so devices like smartphones can message when out of terrestrial coverage.”

As to whether D2D satcom services could in time more broadly disrupt the onboard connectivity market, RGN posed the question at last year’s APEX TECH — regulatory hurdles and other unknowns aside. The faraday cage limitations of air transport category aircraft obviously remain, as multiple stakeholders highlighted at TECH, and Desch highlighted the same in his correspondence about Project Stardust: “I don’t see smartphones connecting well to satellites inside the metal tubes of airplanes — there will likely always be some kind of external antenna to create the best user experience to a satellite, whether it’s to Iridium or another satellite system.”

But could not the small aircraft window-mounted Iridium antennas (which are being used by folks like AirFi for their LEO IFE boxes and elsewhere in business aviation) — or indeed a classic Iridium low-profile antenna — facilitate direct-to-pax Stardust-powered messaging in-flight, RGN asked the Iridium CEO? (Given that 2024 is off to a rough start in terms of aviation safety, it’s not a stretch to believe that some passengers might like to avail of a SOS service in-flight if the functionality is sitting on their phone.)

“Aggregating messaging on an aircraft like AirFi is doing requires more bandwidth (like we provide with the new Iridium Certus 100 platform) while NB-IoT or SBD is better for things like engine monitoring, remote devices and remotely controlling/managing things,” responded Desch.

“AirFi is utilizing multiple antennas as well to ensure great performance from their aircraft service. So, for IFEC to provide the best quality of service, we think something more like Iridium Certus 100 service (utilizing an Iridium Certus 9770-based solution) is a better fit.”

Related Articles:

- Iridium approves third Certus 700 satcom for aero; says more to come

- One-on-one with AirFi founding partner and CEO Job Heimerikx

- Satcom providers stand ready as Iridium introduces Certus aviation

- GEO satellite outage speaks to the value of Iridium LEO mesh network

- AirFi sees world narrowbody fleet as addressable market for AirFi LEO

- Iridium satellite-to-smartphone deal expected to expand pilot take-up