Phasor is “roughly on schedule” for the first version of the electronically steerable antenna (ESA) it is developing in partnership with Gogo to be ready for antenna subsystem-testing by the end of 2019, with certification for aeronautical use anticipated a year later.

The company is simultaneously working on a “Release 2” ESA with Astronics AeroSat, which is expected to be released shortly afterwards.

Phasor also plans to “kick off development” of a Ka-band version of the antenna later this year, preferably with a partner, president and CEO Dave Helfgott tells Runway Girl Network.

Phasor and Gogo announced in October 2016 that they had entered a research and development partnership for the application of Phasor’s ESA to the inflight connectivity market. Phasor later noted that this ‘release one’ technology would initially support connectivity for commercial regional aircraft.

Earlier this year, Phasor and Gogo said they had achieved their initial core-technology performance objectives and would move to the productization phase. Helfgott now tells RGN that the two sides are “very far down the road” on both the core-technology side and the process of integrating the technology into a workable airborne terminal.

Notably, this development is occurring even as Gogo is preparing to roll out a 5G ATG network in 2021. SmartSky will shortly enter the ATG market, with its eyes on the RJ/bizav prize.

“We’re still projecting to come in at the back end of 2020 or early in 2021,” says Helfgott of the ESA project with Gogo, adding that there is “a bit of a question mark” over how long the US Federal Aviation Administration (FAA) certification process will take.

With regards to longer-term plans, Helfgott states: “We have over the next six years a product and technology roadmap with three releases of our technology.”

Each release will provide a “slightly different functionality”, but all three are aimed at “futureproofing” the IFC market in preparation for not only the current-generation geostationary (GEO) orbit satellites, but also for the upcoming wave of low Earth orbit (LEO) and medium Earth orbit (MEO) constellations.

Providing this level of interoperability – which Helfgott says could not be achieved using mechanically-steered antennas – “will help airlines and inflight connectivity providers sleep a little easier at night”.

He believes Phasor has hit the sweet spot in the ESA market – which he says is characterized by “a lot of puffery” – by focusing its efforts on developing active phased array technology that is capable of switching between different non-geostationary satellite orbit (NGSO) systems which pass overhead every few minutes.

Cost has been a barrier to entry for ESAs in aero in the past. But Phasor believes it has the right formula for success.

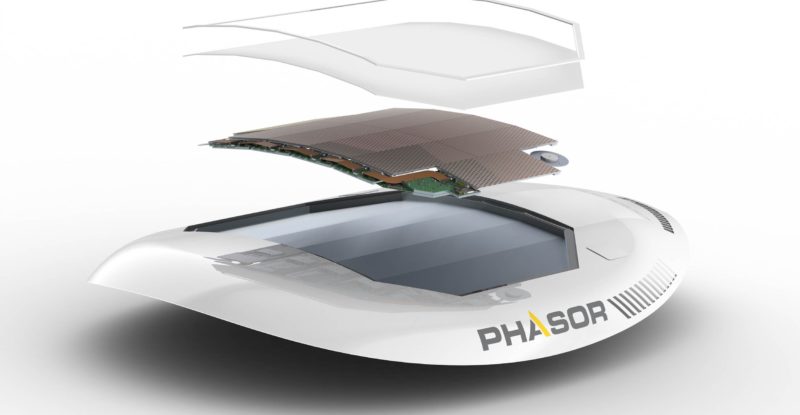

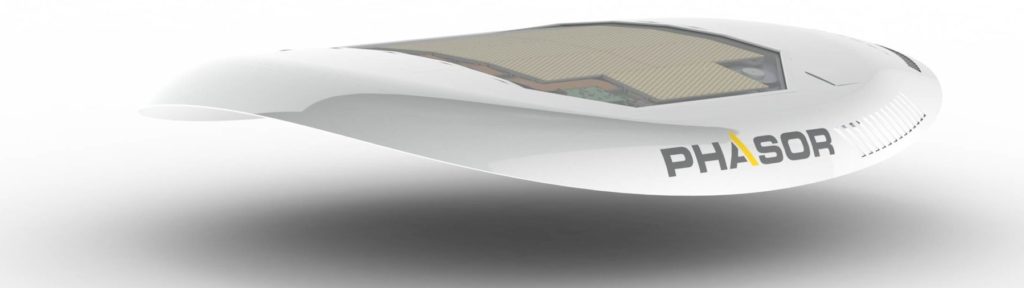

“We think the best approach is with very fast, high-performance active phased array antennas. We’ve struck exactly the right balance between capability, cost and power. We think we’ve got the right mix,” says Helfgott. “ESAs have advantages over mechanically-steered antennas because they have no moving parts, so they can do ‘unnatural acts’ like multi-beam, beam-shaping, active nulling et cetera that you can’t do with a physical antenna.”

While Phasor clearly has one eye trained on the “second wave” of satellites, Helfgott stresses the importance of continuing to focus on the here and now. “There has been lots of hype and hyperbole going on around next-gen antennas and NGSO constellations. It is exciting and the future looks very bright. But we also need to look at what’s available now, and in the near term geosynchronous, high-throughput, predominantly Ku-band satellites with high-powered spot beams will be around for a minimum of 15 to 20 years,” he notes.

Indeed, as the latest issue of Satellite Mobility World notes, by the time LEOs are available internationally, many of the large airlines will have already contracted for and installed Ku and Ka-band GEO services, and due to the high cost of a refit, displacement of existing architecture is unlikely (that’s why, for instance, Safran’s Zii is working on a retrofit solution that would enable an easier upgrade to an ARINC 792-compatible ESA for its customers of Inmarsat GX hardware).

Phasor, meanwhile, has been “holding back” on developing a Ka-band ESA, partly because Ku-band satellites are “still dominant” but also because “we wanted to get our [Ku] products out first”, says Helfgott. However, work will begin later this year on making a Ka-band version of its ESA technology.

“We plan to kick off Ka development this year,” he adds, emphasizing that Phasor “will start working [on Ka] this year, regardless” of whether or not it secures a sponsorship partner.

Related Articles:

- Safran expects its new antenna to be first nextgen cleared for GX

- Gogo’s Thorne and SmartSky’s Stone talk nextgen ATG

- Phasor readies to support crazy ballet handoffs in orbit

- Why airlines are speaking directly to IFC hardware suppliers

- ThinKom sees clear path to supporting LEOs and MEOs with its antennas

- Plug and play spec for next generation aero antennas takes shape

- Kymeta says antenna will fly on commercial qualified aircraft

- Not so fast, a phased array wake-up call, Part 2

- Press Release: Phasor and Astronics to bring ESA to market for aero