Malaysia Airlines recently rebranded its first class product on its Airbus A380 and A350 aircraft as Business Suite, raising the prospect of innovative distribution and potential for a rethink of what business class products truly are as we come to the close of the decade. But as the details of how MAS will sell its products bed in, what are the implications for the wider industry of this opaquely announced product?

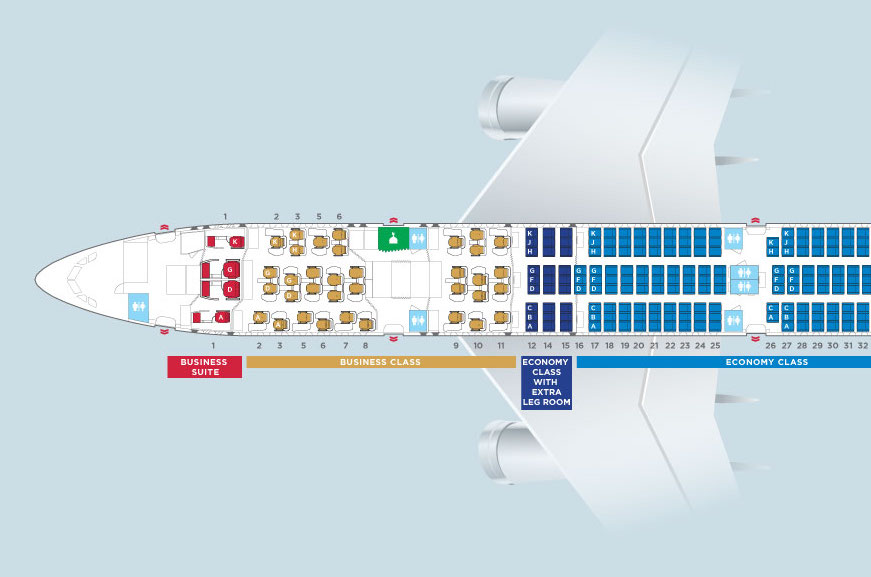

The bottom line for Malaysia Airlines is that, if it wants to be a premium carrier in business class, it needs to offer premium business class seating. With the 2-2-2 flatbeds on its A380 and with the 1-2-2, 1-2-1 regular Vantage configuration on its A350s, its product is being eclipsed, and not just by the premium carriers.

In first class on MAS’ A380, the hard product choice is a legacy of decisions made over a decade and a half ago, and is very similar to many a doored suite with recline-to-flat seat. On the A350, meanwhile, the choice of Vantage XL+ for this product in this configuration is an odd one.

The benefit of the Vantage arrangement is that the feet of business class passengers can, invisibly to first/business suite travelers, tuck into the space in the side table beside travelers in first. Yet Malaysia Airlines is not making use of this, with the business suites separated from the regular Vantage product in business by a full bulkhead without the use of space-saving monuments.

In context, MAS is making the most of the recent acceleration in the trend of muddying the waters between business and first class. This is by no means new: it was happening before Virgin Atlantic introduced Upper Class and has continued since, but the recent moves to push business class upward has leant towards coloring business with a first class tinge and first class language: Delta Business Elite to Delta ONE (using the same product as MAS’ A350 Business Suite), Qatar Airways’ Qsuite, and so on.

The trend is very much that new and improved business seats are being positioned as a new and improved hard product superior to business, but for business fares — not, as MAS is doing, selling older first class suites (on the A380) or slightly less premium first class suites (on the A350) as fares that say business but file as first.

The pricing is also not as keen as it could be. For a midweek booking a few months out, London to Kuala Lumpur return on the A350, MAS is asking £3317 in business and £4617 in the business suite. That’s less of a difference than business and first class usually are, but not close enough to make corporate beancounters wave it through.

One question that MAS can help the industry answer is what the pricing premium might be to go from Vantage to XL+. Image: MAS

On the face of it, the business suite move is around acknowledging the fact that corporate travelers aren’t permitted to fly first class any more — or, at least, that the ones flying Malaysia Airlines aren’t. The problem is that the airline is still distributing these flights as first class.

Branding these seats as Business Suite could be very interesting as an ancillary product. As a pre-departure upsell along the lines of extra legroom or extra baggage, there might be a new niche to discover, along the lines of Spirit Airlines’ popular Big Front Seat, usually available for a fee that seems very reasonable when compared with the passenger experience elsewhere on the aircraft.

But MAS’ systems may not be able to cope with that, so perhaps Malaysia Airlines is doing what it can with the hand that decades of inconsistent management have dealt it. That’s not a new position for the airline to be in: Malaysia Airlines is famous for its heady reversals of strategic course as leadership teams come and go.

The history of its plans for its Airbus A380 operation is just one example: it has attempted to rival Singapore Airlines, mooted all-economy pilgrimage and charter operations, and now moved into a more premium pilgrimage market with its new sub-brand, Amal, for the increasingly lucrative premium segments of hajj and umrah travel. The on-again, off-again plans for a flatbed on its forthcoming Boeing 737 MAX 10 aircraft are another example.

These reversals do not lend themselves well to the long periods of capital and infrastructure investment required for aircraft cabins, let alone aircraft themselves. That’s especially true in business class, where the lifecycle of seats is growing ever shorter.

Selling first class as a Business Suite could allow it to offer truly competitive premium seating while also offering a less premium version at a lower price, and indeed it would be fascinating from an airline industry point of view to see an airline try to sell two different kinds of seat branded as “business”, and to gain data points about the pricing elasticity of a seat like Vantage versus a suite like Vantage XL+. But the lessons learned from this attempt at a premium market may not be immediately applicable in other contexts simply because MAS’ history and mercurial strategic context means that it is uniquely MAS in what it does and how it goes about it.

The A350 business suite is Vantage XL+, but squanders the space-saving nature of the seat. Image: MAS

Related Articles:

- Delta has good reason to be proud of Delta One Suites

- Exploring business class trends for 2019

- Evolving business class suite privacy beyond just adding a door

- Blurring the business-first line leaves a hard product opportunity gap

- Malaysia Airlines shows new direction with new business class

Featured image credited to MAS