Following the successful launch of Amazon’s fourth batch of Ka-band Low Earth Orbit satellites aboard a SpaceX Falcon 9 rocket on 11 August, the tech giant’s Project Kuiper constellation now boasts 102 satellites.

While these are early days for the build-out of Project Kuiper — the initial laser-linked constellation will comprise more than 3,200 spacecraft — the 100-plus satellite milestone brings Amazon a step closer to making good on its mission to deliver “fast, reliable Internet to customers and communities around the world.”

Amazon is hopeful of getting the service into commercial beta “later this year, early next year,” company CEO Andy Jassy said during the firm’s 31 July earnings conference call.

Consumers, Enterprise and Government

Amazon has identified a high need to bridge the “digital divide” for the 400-500 million households worldwide which don’t have broadband today, Jassy said. And whilst it hasn’t commercially launched the low-latency satcom service yet, the firm already boasts “an impressive amount of enterprise and government customers who have agreed to use Kuiper.”

These are its three “key” customer segments. “We have very strong relationships with all three segments,” Jassy noted.

Ostensibly, Amazon sees SpaceX Starlink as the one to beat. “As we get our constellation into space, there will really be two players that have what I would consider the modern technology in Low Earth Orbit satellite. One is the incumbent in the market today and the second will be Project Kuiper,” said Jassy, without naming Starlink outright.

Other players in the LEO broadband space have taken a B2B approach, including Eutelsat OneWeb with its Ku-band satellite constellation, and the forthcoming laser-linked Telesat Lightspeed constellation.

Amazon has partnered with United Launch Alliance (ULA) to deploy the majority of its advanced satellites using Atlas V and Vulcan rockets. But like many other satcom players, it is also relying on SpaceX’s Falcon 9 to ferry at least some of its satellites into space. Arianespace and Blue Origin round out Amazon’s launch partners.

There have been some delays with some rocket providers, Jassy noted.

An aero play

Though not mentioned explicitly on the call, Amazon intends to make a compelling direct offer to airlines, which would see it compete with SpaceX’s Starlink Aviation service, and several other players in the space. Thus far, Starlink Aviation has been selected by new customer Alaska Airlines, airBaltic, Air France, Hawaiian Airlines, Qatar Airways, SAS, United Airlines, Virgin Atlantic, WestJet, ZIPAIR and JSX.

But just as Amazon has helped airlines transform their digital operations on the ground via cloud infrastructure market leader AWS — Iberia signed on in Q2, and Japan Airlines in Q4 2024 — the multinational company could leverage its AWS relationships and pipe Amazon Prime and Audible over Project Kuiper Ka-band LEO satellites to civil aircraft, supporting inflight connectivity on passengers’ own devices and on aircraft seatbacks.

Picture, for example, an airline’s branding wrapped around an Amazon Prime inflight experience, a bring-your-own-license model for IFE. That’s seen as a very easy scenario to accommodate. Well over 200 million people are understood to be Amazon Prime customers.

Another advantage for Amazon, according to space and satellite consultant Christian Frhr. von der Ropp, is that: “Unlike Starlink, Amazon doesn’t need Kuiper to be directly profitable. The strategy is likely to drive growth in its cloud business by enabling globally available, private cloud connectivity — including potential integration with the Space Development Agency’s Proliferated Warfighter Space Architecture (PWSA). For Amazon, Kuiper’s costs will sit in COGS and be effectively subsidized by higher-value cloud services, leveraging Amazon’s extensive position across the digital services value chain.”

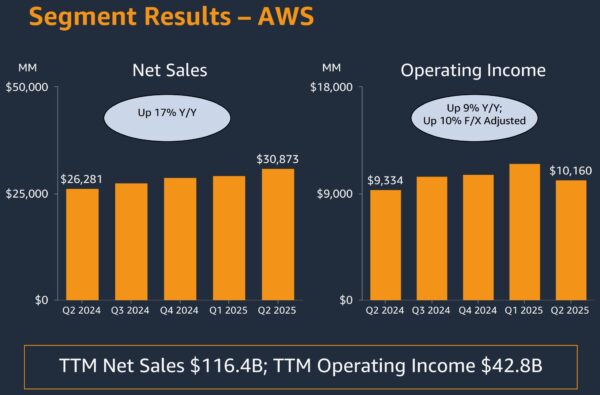

During the second quarter, AWS revenue grew 17.5% year-over-year to $30.9 billion. It now has an annualized run rate of over $123 billion. Image: Amazon

Speaking broadly about how Project Kuiper will differentiate its service for consumers, enterprises, and government, Jassy said on the earnings call: “I think that we will have a pretty meaningful differentiation here in performance. If you look at the performance of what I expect on the uplink and downlink, I think Project Kuiper will be advantaged. I also think the pricing is going to be very compelling for customers. And then, I think if you think about the three key customer segments who want Low Earth Orbit satellite — consumers, enterprises and governments — we have very strong relationships with all three customer segments given our consumer businesses and our AWS business.

“And I think if you think about enterprises and governments, a lot of what they want to do when they take the data down from space is they actually want to put it into a cloud to do analysis, analytics, and AI and various operations on top of it. And the fact that Project Kuiper and AWS are so seamlessly connected is very attractive to enterprises and governments.”

Starlink Aviation is not the sum of Amazon’s competition in the aviation sector. SES and newly acquired Intelsat have each made gains, the former with its multi-orbit MEO/GEO IFC solution — with Neo Space Group serving as aero ISP, and more announcements on the horizon — and the latter with its multi-orbit LEO/GEO offering, inclusive of Eutelsat OneWeb LEO service. The Intelsat multi-orbit IFC kit is now flying on aircraft operated by American Airlines, Air Canada and others.

Hughes Network Systems, a relatively new aero ISP on the scene, has also won some clutch deals to bring multi-orbit, multi-band, multi-network IFC to Delta Air Lines as well as new contracts with two “large” undisclosed airlines. And at least three carriers, including Discover Airlines, have inked deals for Panasonic Avionics’ multi-orbit LEO/GEO offering, which includes Eutelsat OneWeb LEO service.

Notably, network resiliency is in the spotlight following LEO network outages, and curious anomalies of certain GEO satellites, which lend weight to the value proposition for multi-network IFC solutions. Panasonic Avionics’ vice president, connectivity business unit, John Wade, reckons we might ultimately see airlines gravitate to LEO-LEO IFC installs.

To support its aero work, specifically, Amazon is actively hiring “experienced and creative leaders” to drive adoption of Kuiper broadband solutions in aviation.

For instance, a new job listing for a senior aviation solutions architect on the Project Kuiper Mobility Team seeks an individual who has “experience in taking aviation connectivity products and services from concept to in-service, knowledge of aviation certification and qualification processes, working knowledge of airframe structures, and antenna installation” among other attributes.

Amazon recently hired industry veteran Dave Bijur as commercial aviation lead in the Americas. Prior to that, Bijur spent 18 years at Intelsat (formerly Gogo), where he most recently headed up its commercial aviation division. “In my new role, I will be working on Project Kuiper, which will reshape inflight Internet for airlines,” Bijur said in a statement posted to LinkedIn. Intelsat has since been acquired by SES.

Amazon has also made some gains on the aircraft linefit front. Earlier this year, Airbus announced an MOU with Amazon to add Project Kuiper to its lineift, supplier-furnished inflight connectivity program.

“They are part of the HBCplus program today and as soon as their service will be up and running, and they are moving forward very quickly with that, we will be happy to offer them to our customers as part of the HBCplus program,” Airbus head of connected aircraft Tim Sommer said at the time.

Amazon is also slated to exhibit at the forthcoming airline passenger experience-focused conference and exhibition, the APEX Global EXPO in Long Beach, California.

Related Articles:

- Anuvu to sell 100% of company to Platinum Equity

- flyadeal CEO talks inflight connectivity, expects decision by year-end

- Eutelsat touts big LEO revenue growth, new South American airline deal

- Network resiliency in the spotlight after Starlink outage

- EchoStar chief reveals Hughes IFC wins at two large airlines

- Benefits of multi-orbit IFC explored at APEX TECH

- SES completes Intelsat buy with FCC blessing

- Qatar Airways fits Starlink to A350s after completing 777 installs

- Quvia sees aero following cruise with multiple connectivity providers

Featured image credited to istock.com/hapabapa