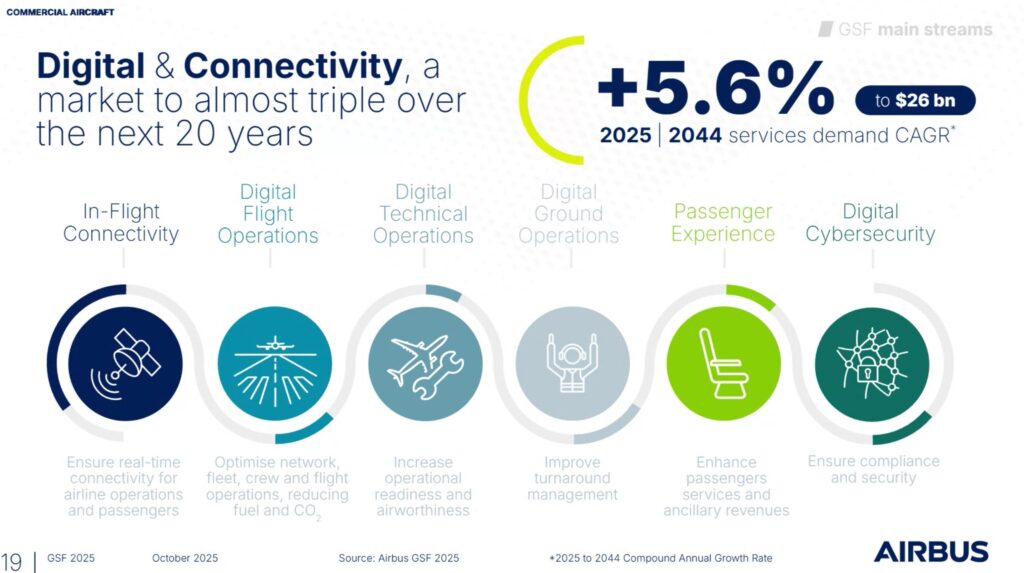

In a testament to the significant importance of aircraft digitalization and connectivity to airline operations and the passenger experience in our modern world, Airbus predicts that demand for Digital & Connectivity services on commercial aircraft will grow from US$9 billion today to $26 billion by 2044.

This impressive trajectory, which equates to a compound annual growth rate (CAGR) of 5.6%, makes Digital & Connectivity the fastest-growing sector among the now-five segments covered in Airbus’ Global Services Forecast (GSF). That’s nearly triple the forecasted CAGR for aircraft Modifications & Upgrades which is pegged at 1.9% through 2044 and covers everything from seat reconfigurations, business class and system upgrades, and other onboard improvements.

Whereas in the past Airbus combined connectivity and aircraft cabin refreshes into one ‘Enhance’ category, it has given Digital & Connectivity its own cluster in this year’s GSF, underscoring the strength of the segment.

Digital & Connectivity services are also expected to outpace the anticipated CAGR of On-Wing Maintenance, Training and even Off-Wing Maintenance in the next two decades. Off-Wing maintenance nonetheless still represents the largest slice of the overall pie, with an estimated value of $218 billion by 2044, as the global commercial fleet nearly doubles to over 49,000 aircraft, and indeed as engine-makers work to remedy issues with new-generation engines that in recent years have forced far too many aircraft to be parked for maintenance.

Acknowledging that it’s charting some current geopolitical and economic uncertainty — including around tariffs, airspace complexity and supply chain disruptions — the European airframer anticipates that the total demand for services will see a 10% year-on-year increase in 2025, and that this will continue to grow alongside expanded air traffic to reach an estimated value of $311 billion by 2044 (anticipating a CAGR of 3.6%).

While China, Europe and the CIS, and North America will become the top three largest services markets by 2044 in terms of total demand, the strongest top three growth rates by CAGR are expected in South Asia, China and the Asia-Pacific region, as aftermarket demand continues its eastward migration, Airbus said.

But the momentum behind connected aircraft and digital services cannot be denied.

But the momentum behind connected aircraft and digital services cannot be denied.

“One of the key trends we witness today is a trend to connect the aircraft, especially with satellite connectivity. So today we’ve got around 11,000 aircraft connected. It’s twice the number that we had in 2010,” Airbus head of services marketing Arnaud Demeusois said during a media briefing to discuss the Global Services Forecast.

“Often, when we think connectivity, we think passenger connectivity, Wi-Fi on board,” Demeusois continued. “But in fact, there’s a lot more that we believe can be done with connectivity to improve operations.”

As an example, he pointed to Qantas low-cost subsidiary Jetstar’s use of the Skywise open data platform. Developed by Airbus and US data analytics technology company Palantir, Skywise monitors data from the carrier’s A320 family aircraft to provide early alerts of upcoming system degradation and required servicing — effectively predicting and preventing maintenance issues before they occur.

Harnessing AI technology, Skywise has prevented dozens of flight cancellations at Jetstar, and according to an exclusive report from 9 News Australia this spring, the technology has contributed to a 93% reduction in engineering related cancellations at the airline.

Jetstar’s A320s are not fitted with cabin connectivity for passengers, but as Airbus explained to Runway Girl Network in the past, Skywise doesn’t need IFC to power predictive maintenance (though it can easily operate via cockpit communication pipes). Indeed, Airbus can pull large volumes of data from Skywise’s FOMAX (Flight Operations and Maintenance Exchanger) via a 4G Gatelink antenna on the crown of the aircraft.

“We can monitor aircraft health very quickly,” Demeusois noted. “We take this data with smart algorithms, and that means putting our engineering knowledge into an algorithm. It’s not that simple to do, but with smart algorithms, we can detect when a component, a system, starts to show signs that maybe it could dysfunction in the next few cycles, and that triggers an alert in the next five to 10 cycles that ‘this component is 95% likely to have a failure, which could cause an AOG, an aircraft on the ground,’ and it gives this heads up, with long enough time for the airline to react properly,” the Airbus executive explained during the media briefing.

As such, airlines can avoid a lot of disruption in the network, he said, adding:

It’s not about the future. It’s happening today. It’s what you can do with data and connectivity. It’s just the beginning because there are a lot more use cases using this for operations and again, it’s why we’re saying it’s not only Wi-Fi in the cabin, but also a lot of operational improvements we can bring. And we are strong believers of this and working on these items.

That said, the passenger experience is also quite important, which is why Airbus has adopted a new ‘smartphone-like’ approach for broadband cabin connectivity, whereas airlines can swap managed service providers (MSPs) whilst retaining the linefit terminal hardware.

“Today, when you have a smartphone and you change operator, you don’t change any hardware on your smartphone; just change the operator on the aircraft,” Demeusois noted. This is the model Airbus has pursued for its linefit, supplier-furnished HBCplus inflight connectivity program about which RGN has covered extensively. And indeed, Airbus has already secured 14 customers for HBCplus, Demeusois revealed.

In addition to supporting predictive maintenance and the passenger experience, digital and connectivity solutions are also supporting flight deck communications including advanced electronic flight bag (EFB) applications for pilots, as well as powering fuel-saving flight paths to ensure a more seamless passenger experience. And so, there’s little wonder as to why Airbus has given Digital & Connectivity a cluster of its own in this year’s Global Services Forecast. Digital is also having a massive impact on ground operations, with new efficiencies being realized.

“With the reclustering of the Airbus GSF, we consider a bigger part of the ecosystem in which our customers operate. Especially, digital solutions are becoming real multipliers, enabling operators to scale up without compromising on reliability or cost. This can lead to unlocking the potential of more than US$83 billion in annual operational savings for our customers, through an increasing number of digitally connected aircraft — from 11,000 today to over 40,000 by 2044,” said Airbus SVP customer services Cristina Aguilar Grieder.

“With the reclustering of the Airbus GSF, we consider a bigger part of the ecosystem in which our customers operate. Especially, digital solutions are becoming real multipliers, enabling operators to scale up without compromising on reliability or cost. This can lead to unlocking the potential of more than US$83 billion in annual operational savings for our customers, through an increasing number of digitally connected aircraft — from 11,000 today to over 40,000 by 2044,” said Airbus SVP customer services Cristina Aguilar Grieder.

Going forward, Airbus said it’s open to a further reclustering. It is exploring two further market segments that are driving customer demand: maintenance operations support which includes “essential enablers such as engineering services, technical records, inventory management, and fleet-wide planning for MROs and operators alike” and ground operations, which it describes as “a critical link between airside efficiency and aircraft turnaround performance where important technological developments are happening and new services will be made available.”

All images and graphics credited to Airbus.

All images and graphics credited to Airbus.