Safran announces the contemplated acquisition of Collins Aerospace’s high-technology actuation and flight control activities, which are mission critical for commercial & military aircraft and helicopters. The business has around 3,700 employees across eight facilities in Europe (France, UK and Italy) and in Asia, and also benefits from MRO and engineering capabilities. It is expected to generate sales of approximately $1.5 billion and an EBITDA of $130 million in 2024E.

Safran announces the contemplated acquisition of Collins Aerospace’s high-technology actuation and flight control activities, which are mission critical for commercial & military aircraft and helicopters. The business has around 3,700 employees across eight facilities in Europe (France, UK and Italy) and in Asia, and also benefits from MRO and engineering capabilities. It is expected to generate sales of approximately $1.5 billion and an EBITDA of $130 million in 2024E.

Olivier Andriès, Chief Executive Officer of Safran, commented: “The contemplated transaction represents a unique opportunity to develop our position in mission critical actuation and flight control functions. Our highly complementary product offerings would create a global leader in these segments with around $1.8 billion of sales.

“The transaction would enable us to deliver a comprehensive offering to our clients and position us extremely well for next-generation platforms as the segments move toward increased electrification. The business is a perfect fit with both our product portfolio and our DNA with leading technologies, recurring aftermarket sales, and profitable growth.”

The transaction is expected to generate approximately $50 million of annual pre-tax run-rate cost synergies, which would be progressively implemented from 2025 to 2028. Such synergies would notably come from economies of scale in procurement, R&D complementarity, internalization of sourcing and production flows. In addition, commercial synergies would be obtained through integrated offerings and a diversification of customers and geographic mix. Commercial synergies would continue post 2028 with run-rate achieved on next-generation aircraft by the middle of the next decade.

The enterprise value of $1.8 billion would represent a multiple of ~14x pre-cost synergies and ~10x post run-rate cost synergies based on 2024E EBITDA, with an expected IRR and ROCE 2028E of the transaction exceeding the Group’s WACC and with an accretive impact on Safran earnings per share from year one. As part of the contemplated acquisition, long-term supply agreements (covering ~25% of sales) would be secured between Safran and Collins at attractive terms. The transaction is expected to be fully financed with available cash, with a limited impact on the Group’s net leverage and a reiterated commitment to the robust Group’s investment grade rating.

Key strategic benefits of this transaction for Safran include:

- Highly complementary product offerings creating a leading player (~$1.8 billion combined sales in 2024E) with an end-to-end product portfolio – Collins’ actuation and flight control business would bring Safran a full set of capabilities and products enabling the Group to become a leading integrated player with an end-to-end actuation and flight control product portfolio;

- Synergetic exposure across commercial, military aircraft and helicopter segments, with strong legacy programs – These additional capabilities would offer Safran a well-balanced exposure to diverse customer segments and product categories and strong positions on mature and growth platforms

- Complementary capabilities in hydraulic and electromechanical actuation positioning Safran well for next-generation aircraft – Collins’ best-in-class hydraulic and mechanical actuation capabilities would combine with Safran’s current know-how in electrical actuation and electronics and well-position the Group for future aircraft programs;

- Attractive exposure to valuable and recurring aftermarket revenue streams – c. 40% of the acquired sales stem from aftermarket which would allow Safran to strengthen its exposure to this highly attractive revenue source;

- Compelling value creation supported by short-medium term cost synergy potential – Well-identified sources of cost synergies, with further upside to be captured from commercial synergies

The contemplated transaction is subject to the information and consultation procedure with the relevant employee representative bodies of Collins and Safran, as well as the customary regulatory approvals and closing conditions. Closing is expected to take place in the course of H2 2024.

Safran will host today a conference call for analysts and investors at 9.30am CEST.

To follow the conference call, please register using the link below in order to receive by email the connection details (dial-in numbers and personal passcode):

https://register.vevent.com/register/BIb2bfd60b6e4140c58969225286f8aaaa

A replay will be available 2 hours after the event concludes and remains accessible for 90 days by using the following link: https://edge.media-server.com/mmc/p/2tgwb2wc

Safran is an international high-technology group, operating in the aviation (propulsion, equipment and interiors), defense and space markets. Its core purpose is to contribute to a safer, more sustainable world, where air transport is more environmentally friendly, comfortable and accessible. Safran has a global presence, with 83,800 employees and sales of 19 billion euros in 2022, and holds, alone or in partnership, world or regional leadership positions in its core markets. Safran undertakes research and development programs to maintain the environmental priorities of its R&T and Innovation roadmap.

Safran is listed on the Euronext Paris stock exchange and is part of the CAC 40 and Euro Stoxx 50 indices.

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements relating to Safran, its existing actuation business (“SAB”), Collins Aerospace’s Actuation and Flight Control business (“CAFCB”) and the combined SAB and CAFCB businesses (“SACAFCB”) which do not refer to historical facts but refer to expectations based on Safran’s management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those included in such statements. These statements or disclosures may discuss goals, intentions and expectations as to future trends, synergies, value accretions, plans, events, results of operations or financial condition, or state other information relating to SAB, CAFCB and SACAFCB, based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “would,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Many of these risks and uncertainties relate to factors that are beyond control. Such factors may cause Safran’s actual results, performance or plans with respect to the contemplated transaction to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements. Therefore, investors and shareholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: uncertainties related in particular to the economic, financial, competitive, tax or regulatory environment; risks related to the ability to complete the contemplated transaction on the proposed terms or on the proposed timeline; other risks associated with executing business combination transactions, such as the risk that CAFCB will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the contemplated transaction will not be realized; risks related to future opportunities and plans for SACAFCB; the possibility that, if SACAFCB does not achieve the perceived benefits of the contemplated transaction as rapidly or to the extent anticipated by financial analysts or investors, the market prices of Safran shares could decline, as well as other risks related to SAB, CAFCB and SACAFCB; the full impact of the outbreak of the COVID-19 pandemic; the full impact of the Russo-Ukrainian conflict.

The foregoing list of factors is not exhaustive. While the list of factors presented here is representative, no list should be considered a statement of all potential risks, uncertainties or assumptions that could have a material adverse effect on Safran’s consolidated financial condition or results of operations. The foregoing factors should be read in conjunction with the risks and cautionary statements discussed or identified in the public filings made by each company. Forward-looking statements speak only as of the date they are made. Safran does not assume any obligation to update any public information or forward-looking statement in this document to reflect events or circumstances after the date of this document, except as may be required by applicable laws. Neither Safran, nor any of its advisors accepts any responsibility for any financial information contained in this document relating to the contemplated transaction, business or operations or results or financial condition. We expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in the expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

USE OF NON-GAAP FINANCIAL INFORMATION

This document contains supplemental non-GAAP financial information. Readers are cautioned that these measures are unaudited and not directly reflected in the Safran’s financial statements as prepared under International Financial Reporting Standards and should not be considered as a substitute for GAAP financial measures. In addition, such non-GAAP financial measures may not be comparable to similarly titled information from other companies.

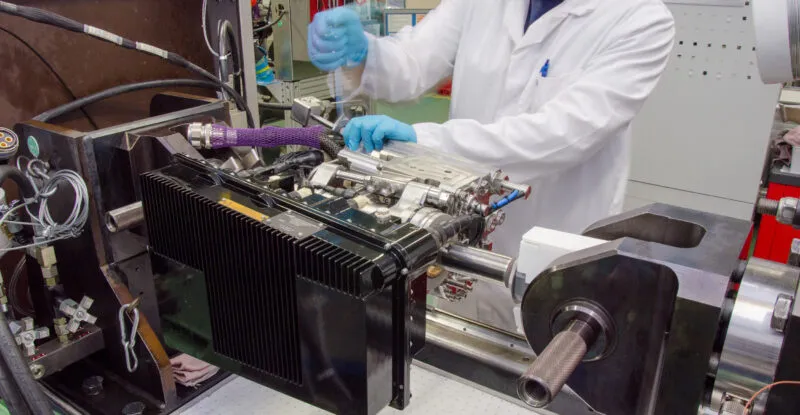

Featured image credited to Collins Aerospace