Organizations are in a continual struggle to balance business-as-usual activities against investing in innovation. This is especially so in industries which have traditionally been fueled by research and development. The aerospace and defense (A&D) sector is a perfect example. The rise of cloud computing means that A&D organizations not only need to think about maintaining existing assets but, in many cases, they also have to consider moving those existing products and services to allow them to take advantage of the benefits that cloud computing can bring.

This tension is further compounded by an increasingly complex cybersecurity environment. While it is generally consumer-facing cyber-breaches that make the headlines (think Anthem, Target and many others), A&D organizations are continuously being attacked by increasingly sophisticated parties who themselves leverage cloud computing to increase the scale and impact of their activities.

Add to this sequestration, and its corresponding impacts on defense spending, and you have a time of real stress for the A&D industry.

A recent A&D market survey, conducted jointly by IT vendor CSC and the Aerospace Industries Association (AIA), polled senior executives and senior managers at global A&D companies.

The survey found that the recovery of the global economy post GFC and increased demand for commercial aircraft are lifting the A&D industry out of a challenging market.

But the current regulatory climate is affecting R&D investments at a time when A&D companies are facing a widening skills shortage, and the need to ramp up investment in cybersecurity tools.

Key takeaways from the survey include:

- Designing and producing innovative products and up-selling and cross-selling products continue to be top goals in the commercial sector. However, pricing pressures are forcing organizations to pursue continuous-improvement and cost-containment measures, slowing the rate of innovation.

- Technology modernization continues to be a major initiative, focusing on application replacement or modernization, and IT infrastructure modernization. Cloud computing is cited as a priority for implementing modernized applications by 41% of respondents.

- Finding skilled workers to replace the industry’s graying workforce continues to be a key factor affecting A&D companies. Critical areas include aerospace engineering, mechanical engineering and cybersecurity.

- Sequestration has taken a toll on overall defense spending, with 65% of respondents citing budget uncertainty for decreased investments in R&D. Only 50% of respondents say they are investing in R&D, with cybersecurity, UAVs and electronic warfare topping the list of R&D investments.

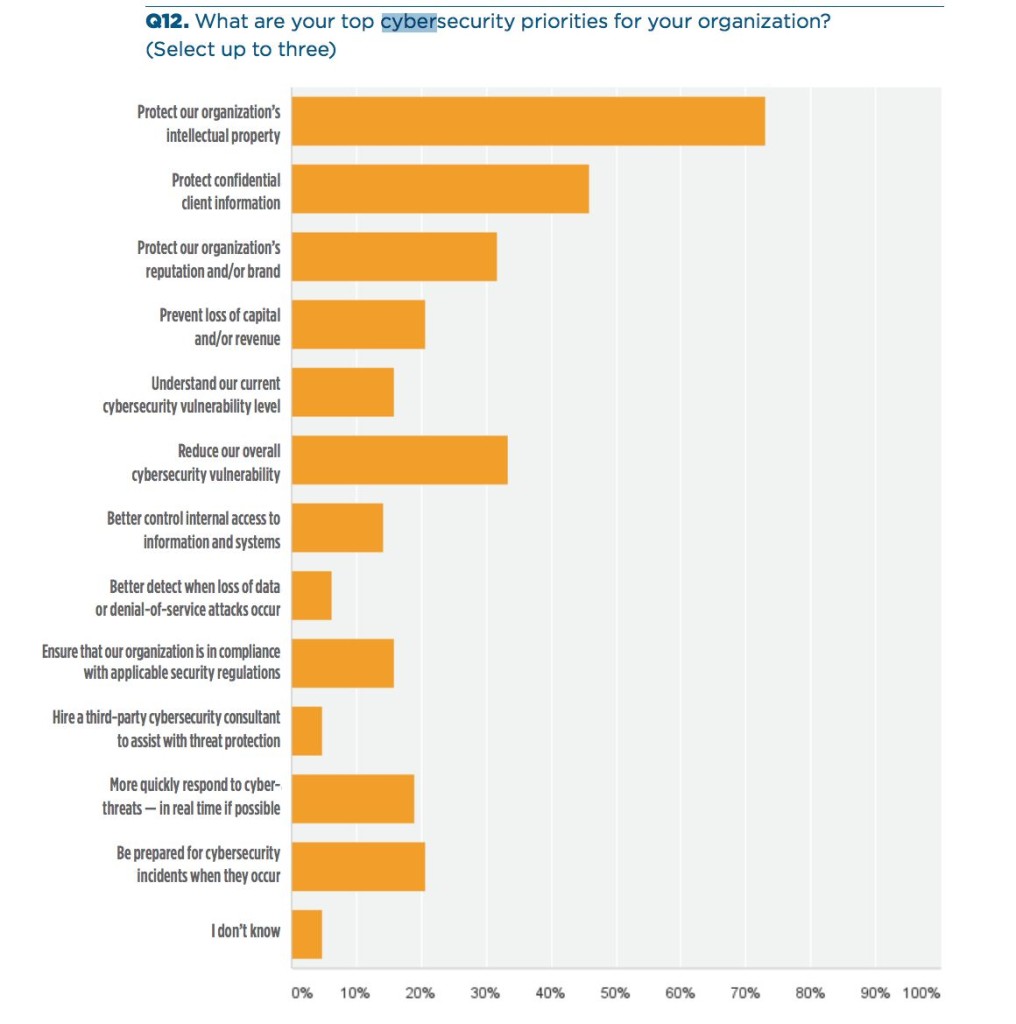

- A majority of respondents (67.8%) report increased spending to protect against cyberthreats, with nearly half of those (29%) spending 25% to 50% more on cybersecurity in the past year.

Nearly half of respondents (46.8%) reported that cybersecurity threats had increased “Somewhat” or “Significantly.” Only 11.3% said cyberthreats had decreased over the past year.

Nearly half of respondents (46.8%) reported that cybersecurity threats had increased “Somewhat” or “Significantly.” Only 11.3% said cyberthreats had decreased over the past year.

“These results are no doubt partly in response to a series of high-profile attacks on A&D companies, retailers, banks and Internet service providers. Increasingly, cybersecurity efforts are focused on deterring such attacks before they take place, especially in the government sector, which has the necessary resources and tools to focus on prevention. Preventing threats is a key goal in the A&D industry, which is an early adopter of cyber-physical systems, where intelligent software is embedded into hardware and usually connected to a network,” states the report.

“Adding more software-defined and connected products to the aviation industry is making cybersecurity and physical security more difficult than ever. Other threats focus on manufacturing infrastructure. Often not considered mainstream IT, manufacturing shop floor networks and devices are potentially vulnerable to attack. A breach of manufacturing process data in military and commercial systems could help attackers reverse-engineer critical proprietary systems.”

In response to pricing pressures and lower government spending, A&D companies are becoming more selective in their R&D investments and are more focused on product innovation, continuous improvement, technology modernization, and cybersecurity, it adds.