When Gogo announced its hybrid Ground-to-Orbit (GTO) solution last September it included an aggressive timeline from launch partner Virgin America to get the hardware certified and installed.

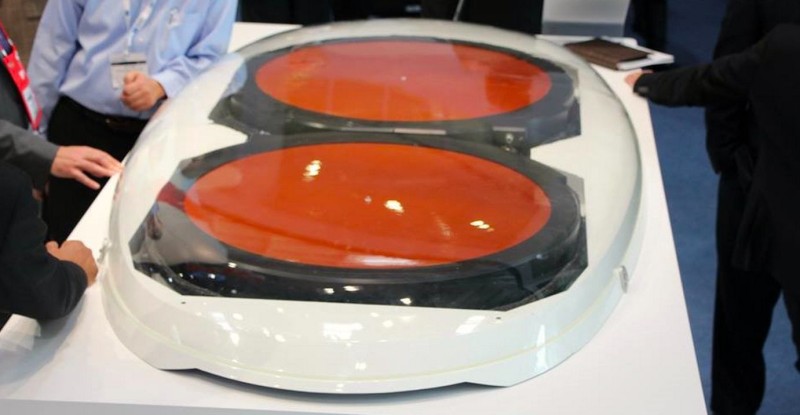

In the ensuing months questions have arisen about the airline’s commitment to that timeline and even its overall commitment to the GTO product versus either keeping ATG-4 or leapfrogging to the newer 2Ku platform (pictured above). And, somewhat surprisingly, executives from Gogo seem to think that’s not a problem at all, with one going so far as to say “it doesn’t matter” if GTO doesn’t enter service as previously announced because the groundwork it laid for 2Ku was a necessary investment for their technology roadmap.

Speaking at a recent media event at Gogo headquarters, company CTO Anand Chari remained upbeat on the potential for the GTO solution and talked about advantages it holds over the 2Ku option in certain circumstances:

On those planes where ATG-4 is already available and on those planes that are exclusively going to serve North American routes you can add only one antenna. It is lower CapEx and lower OpEx. And it is lower data transport costs. [ATG] is still a lot more efficient way to transport data than the return link through the satellite.

Chari also spoke of the built-in redundancy the GTO solution offers as it is able to manage communication to the plane via the ATG link should there be issues with the satellites. That’s good news, but just how broad is the potential for such deployments?

Very few mainline aircraft operated by US carriers are limited only to running routes within the ATG coverage area. United Airlines and American Airlines have their dedicated transcon premium cabin fleets, for example, but most aircraft for which the satellite-based capacity makes sense also fly to Hawaii the Caribbean or Latin America. That would render the ATG uplink out of service and leave the aircraft offline for the trip. For these aircraft the 2Ku solution – despite the higher CapEx and OpEx – is the ideal choice.

Fortunately for the airlines (and for Gogo) the timeline to deploy 2Ku is not too far behind the originally planned GTO rollout. Chari noted that the GTO solution is already in testing with the FAA and that the 2Ku solution “leverages GTO technology in more than two thirds of the components.” There are a couple components still in development for the 2Ku solution but the company expects to be certifying them with the FAA in the very near future.

Gogo CEO Michael Small also suggested at the event that it may never be possible to keep up with passengers’ ever-increasing demands for bandwidth, a view echoed by other industry executives. The GTO solution is capped at 3.6Mbit for upload bandwidth based on the ATG-4 platform which may prove to be a factor which further limits the viability of the solution, though passengers are still predominately downloading data rather than uploading.

As to the open questions about patent licensing, Gogo management indicated it is not concerned based on their current systems architecture. Gogo did acquire some patents from LiveTV as part of the Airfone acquisition but those are not related to the GTO architecture, according to company officials. An additional patent purchase, currently reflected as an intangible asset on Gogo’s balance sheet, was described by an executive as a “defensive move” based on the low acquisition cost.

For Virgin America, which posted a $22.4 million first quarter loss – and indeed for other Gogo customers – the ATG-4 rollout has been sufficient to buy more time before making a firm decision on GTO or 2Ku. The increased bandwidth of the ATG-4 platform has led to a significant reduction in customer complaints according to Gogo’s internal tracking. That may be a sufficient stop-gap allowing them to wait until 2Ku is ready for service rather than investing in GTO.

Given the limited delay for deployment and the overall improved capacity numbers which 2Ku offers it may just be that a minimal or non-existent deployment of the GTO platform really doesn’t matter. Gogo may actually leapfrog itself to the 2Ku solution, skipping GTO as a commercial product while still building on its technology to support the future systems; Vaporware which actually yielded a better product in the end.