In 1999 United Airlines introduced Economy Plus seating. It is an extra 4-6 inches of legroom in a standard economy seat and is available for purchase or as a complimentary upgrade for elite United Mileage Plus members. It took 12+ years before United’s primary international competitors, Delta Air Lines and American Airlines, caught on, adding Economy Comfort and Main Cabin Extra respectively. While these extra leg room options are welcomed, more is needed. Since the introduction of Economy Plus, there are two key factors that have brought the passenger experience to where it is today.

The first is the removal of international first class from most cabins. Previously, seats that turn into beds were only the realm of first class, but that has changed drastically. Flat bed seats are now standard issue for all international business class aircraft at US carriers. This reduced product differentiation and tightening corporate travel policies have reduced the market for first class to a few key markets. Delta has no international first class. United only has it on legacy United aircraft, legacy Continental was only a two-class carrier. American is removing first class from all its Boeing 777-200 aircraft. The net effect is that we are seeing business class offerings have gotten much better at American carriers. Business class is the new first.

The second factor is yield. While in previous decades, US carriers were primarily driven by market share, the combination of 2008’s oil shocks and Chapter 11 bankruptcies has seen a focus on increased passenger yield. Passenger costs are measured in a unit called Cost per Available Seat Mile (of CASM). Take the all-in trip cost of a flight, dived that by the flight distance, and further divide that by the number of seats on the plane, and that is your CASM.

The easiest way to reduce CASM is to increase the seat count. Carriers have done that in two ways – first by reducing the distance between seats (seat pitch), which is accomplished by replacing seats with thinner, “slimline” offerings, and second by reducing seat width and adding another column of seats. This was first done at charter companies for tourist markets, but gained industry-wide acceptance when Emirates started configuring its Boeing 777 fleet in a 3-4-3 arrangement, where 3-3-3 or 2-5-2 had been the previous standard. Similarly, Boeing’s new 787 is offered both in a 2-4-2 and 3-3-3 configuration, but only Japan’s ANA has opted for the reduced density layout. Airbus has recently been advancing the idea of an 11-abreast configuration for its A380 Super Jumbo, having delivered all its aircraft in a 10 abreast configuration on the main deck (with 8 abreast on the narrower upper deck). Boeing is marketing its new 777X with 3-4-3 as the standard configuration. Economy class is getting more cramped. With the chasm between Economy Class and Business Class growing, US carriers need to offer their passengers something in between.

The concept of a separate Premium Economy class is not new. British Airways, Air France, Virgin Atlantic, JAL, ANA, and Qantas all offer it, amongst many others. It differs from the Economy Plus, Economy Comfort and Main Cabin Extra products on United, Delta and American in that it is a different seat and a separate cabin from economy class. Premium Economy offerings range from 19 to 21 inches wide, with a 38- to 40-inch seat pitch and built-in leg rest. American’s latest economy class offering on its flagship Boeing 777-300ER is a 17-inch wide seat with a 31-inch pitch, increasing to 36 inches in Main Cabin Extra[1]. Whereas the US carriers give their extra legroom seats to elite customers, flyers that want to sit in premium economy class must purchase a premium economy ticket. They are separate fare classes with separate fare buckets.

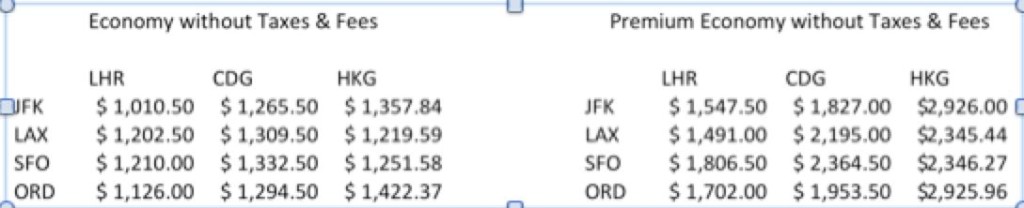

A Premium Economy seat is bigger than a standard economy one, but it also more profitable. Based on Cathay Pacific’s recent refit to its 777-300ER aircraft, where it took out economy seats to add a premium economy cabin, the total footprint of a premium economy seat is 67% greater than an economy seat[2]. A survey of deeply discounted fares on 12 city pairs shows premium economy to be 44% more expensive than an economy fare on the same flight, inclusive of all taxes and fees. Removing taxes and fees results in a 74% premium over economy base fares[3]. Adding premium economy has had the greatest impact at Cathay Pacific. There, premium economy fare sells for double (net of taxes and fees) the base economy fare, giving a 54% increase in yield per square foot of cabin. In an industry with razor thin margins, this looks to be some of the most profitable real estate in the air.

The premium economy cabin can also help protect business class yields by serving as an upgrade buffer. American carriers have fostered an upgrade culture that erodes yields in their premium cabins. Unsold business class seats on domestic flights are given away for free to elite frequent flyers holding economy tickets. This problem is lessened on international flights, due to restrictions on upgrades from set fares, but is still there due to upgrade certificates and awards each carrier has built into their frequent flyer programs. Placing a premium economy cabin between economy and business prevents a flyer from buying a deeply discounted economy fare and getting a business class seat (The ultimate yield killer). In order to upgrade a ticket to business class, the passenger’s base fare would have to be premium economy. Similarly, a bargain basement economy fare could only be upgraded to premium economy. In addition to being its own financial reward for airlines, premium economy helps protect the biggest profit drivers in the industry: international business class.

One of the major changes the industry has seen over the past few years is the proliferation of anti-trust immunized joint ventures. These tie-ups between carriers have created airline teams competing for business. For example, on all flights between the United States and London Heathrow, all American flights carry a British Airways code and vice versa. Ideally, passengers are completely agnostic between carriers in a JV, and can receive a similar experience regardless of whose plane they are actually flying. When inflight products are comparable, this is a realistic notion. The inflight experience should be similar but British Airways offers a premium economy product that American simply doesn’t have. If someone thought they were purchasing a World Traveler Plus seat, and found themselves in Main Cabin Extra, they would not be happy. American is in a similar position in its joint ventures with JAL and Qantas. Delta is in the same place with both Air France and Virgin Atlantic. Star Alliance founder Lufthansa recently floated the idea of a common economy class seat across the entire Star network. If this is the future of international travel, these super-alliances need product commonality to make an effective pitch to customers.

The proliferation of fees in the last few years has been called unbundling by airlines. Their rationale is that by pulling extras out of the price of the ticket, passengers choose what they want to pay for. Adding another cabin between economy and business class also lets passengers choose what they want to pay for. The US carriers have made big strides of late with their business class offerings but are noticeably deficient when it comes to something in between economy and business. Simply adding legroom won’t solve the problem when you’re bumping shoulders with another passenger for 10 hours at a time. Carriers around the world have proven that customers will pay for more personal space and a more comfortable seat. It’s time for US carriers to catch up.

[1] The Main Cabin Extra seat on the American 777-300ER is also wider at 18 inches, however given that this is the old standard, it can hardly be called an upgrade.

[2] This number varies from carrier to carrier and includes extra bulkheads and dividers, as well as spacing between cabins.

[3] Fare data from Expertflyer.com for same-flight fares for round trips May 20 to 27th 2014. Weighted average of 12 routes based on flight length. Each route is average of cheapest fare bucket in each class, priced from both cities on route. All fuel surcharges are included with base fare.