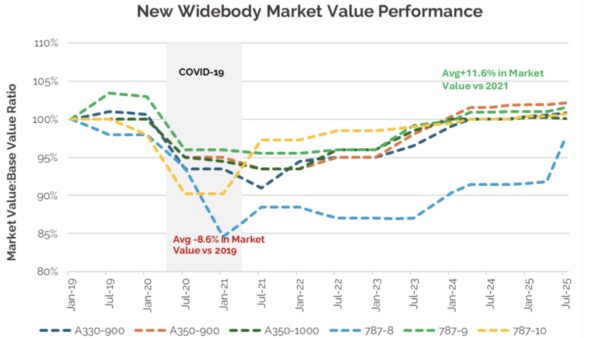

IBA, the leading aviation market intelligence and advisory firm, reports that Market Values for new generation widebody aircraft have risen by an average of 11.6% since 2021, reflecting a sustained recovery in long-haul demand, active fleet renewal, and strong aircraft trading activity.

IBA, the leading aviation market intelligence and advisory firm, reports that Market Values for new generation widebody aircraft have risen by an average of 11.6% since 2021, reflecting a sustained recovery in long-haul demand, active fleet renewal, and strong aircraft trading activity.

Intelligence from IBA Insight reveals that, following a sharp decline during the pandemic when average widebody values dropped by 8.6% compared to 2019, this aircraft segment has experienced a steady value rebound.

Market Value-to-Base Value ratios are now at or above 100% across most widebody types, including the Airbus A350-900, A350-1000 and Boeing 787-9, reflecting heightened demand and persistent supply constraints.

According to Hashen Hewawasam, Head of Commercial Aircraft Valuation at IBA, the value rebound has accelerated since early 2023, as international travel and premium leisure traffic returned. Long-haul capacity growth, combining with OEM production constraints and lead times extending into the 2030s, has created a seller’s market for new generation widebodies.

Aircraft such as the A350 and 787 families continue to anchor market activity, favoured for their fuel efficiency, reduced emissions, and competitive economics. The 787-9 remains the most in-demand variant, with Market Values now trending above Base across all ages of the aircraft type.

The 787-10 has also recovered to Base Value levels, with the strongest performance seen in new production units. Interestingly, the 787-8, despite limited new deliveries, has posted the fastest Market Value gains, driven largely by tight widebody availability, although values remain just below base for now.

The 787-10 has also recovered to Base Value levels, with the strongest performance seen in new production units. Interestingly, the 787-8, despite limited new deliveries, has posted the fastest Market Value gains, driven largely by tight widebody availability, although values remain just below base for now.

The A350-1000 has benefited from delays to the Boeing 777X programme, securing significant orders and supporting robust value performance alongside the A350-900. The A330-900 is also showing positive momentum in the secondary market, particularly as a viable A330ceo replacement.

The Sale and Leaseback (SLB) market has further reinforced Market Value growth. Airlines seeking capital amid constrained supply have driven increased SLB activity, with new lessor entrants offering aggressive pricing and Lease Rate Factors (LRFs).

IBA expects values for new generation widebody types to remain on an upward trajectory, aided by OEM price escalation, inflation, and continued long-haul recovery. While growth may lag that of narrowbodies due to lower production and trading volumes, the widebody outlook remains fundamentally strong.

View more IBA expert analysis here.

About IBA

IBA delivers the best of all worlds — deep aviation consultancy expertise, and cutting-edge and actionable data insights, all delivered by a proven, expert team with a strong customer focus.

An independent, innovative and forward-thinking business, IBA has over 35 years of heritage and experience in aviation. Having won the Sustainable Technology award for its IBA NetZero platform in 2024 & 2023 and for its Carbon Emissions Calculator in 2022, and being named ‘Appraiser of the Year’ by their clients for five years, IBA prides itself on its integrity, fierce independence, and continual innovation.

The key to IBA’s success is its people – some of the best in the industry, based in multiple locations across the globe – real experts who are passionate about aviation and go the extra mile for their clients.

Featured image credited to Airbus SAS/Borja Garcia de Sola. Embedded graphic credited to IBA