As Low Earth Orbit (LEO) satellite connectivity pipes have joined other links on deck in support of hybrid network solutions in the cruise line industry, Quvia, the first AI-powered Quality of Experience (QoE) platform for ships, planes and remote sites, has a bold prediction for aviation: “we think that aviation is five years behind cruise.” That paradigm might ultimately see multiple service providers powering broadband cabin connectivity on a single aircraft in contrast to the single provider-per-aircraft model of today.

Quvia has deep visibility into how LEO, multi-orbit, multi-network, and multi-band connections are shaping the passenger experience on cruise liners. The firm’s AI-powered Grid platform seamlessly blends connectivity on ships across multiple providers, orbits and networks, allowing all available bandwidth to be consolidated into a single pipe, whether LEO, Medium Earth Orbit (MEO), or geostationary (GEO) satcom, 5G, LTE, fiber, microwave, and Wi-Fi.

“If you go back to cruise five years ago, when we were involved, the cruise industry made some strategic changes regarding how they buy hardware, how to not vertically integrate, and how they make those changes to go do that. At the same time, you saw Starlink come into the marketplace, and that has washed through that industry in a big way,” Quvia senior vice president, aviation Mike Moeller explained to RGN during a sit-down interview at the Aircraft Interiors Expo (AIX) in Hamburg and separately as part of the IFC Revolution panel moderated by your author at last week’s APEX TECH conference in Los Angeles.

“So where Quvia fits into that with our product called Grid is we do the network orchestration when there is, for instance, 14 Starlink antennas, a couple of GEO Ku, a couple of GEO Ka, there’s mPOWER (MEO), there’s microwave, there’s C-band, there’s all of these different links off the ship, and so we orchestrate all of that via AI every 50 milliseconds, based on where the ship is, what day it is, where it’s going, and what’s going on with the link.”

Armed with this capability and immense data sets — and given that some airlines have already grown comfortable with the notion of installing two antennas atop aircraft in support of IFC — it is perhaps unsurprising that Quvia anticipates aviation will take a similar multi-provider leap as the cruise industry, albeit a modified version given that the figurative real estate atop aircraft fuselages is not nearly as vast as the decks on cruise liners.

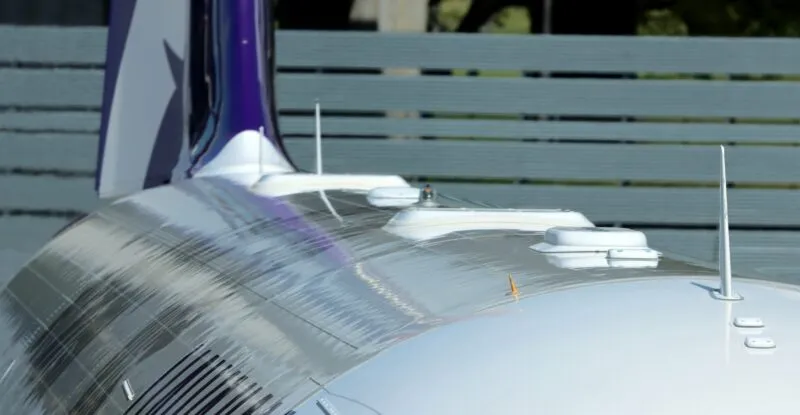

“Two years ago, people would laugh if you talked about two antennas on aircraft, and suddenly, now two antennas are the norm,” noted Moeller. From the dual phased array configuration of Starlink for narrowbody and widebody aircraft (as pictured at top) to Hughes Network Solutions’ multi-orbit, multi-network, multi-beam and multi-band Hughes Fusion hybrid architecture that will roll out on select Delta twinjets (pictured below), airlines have clearly grown more comfortable with multiple IFC antennas.

Hughes Fusion uses ThinKom Solutions’ ThinAir Plus architecture, which pairs a ThinKom Ka2517 VICTS antenna to support Ka-band GEO, with a Hughes Ku-band LEO-only electronically steerable antenna to support Eutelsat OneWeb LEO.

“And so, as everybody races to the edge of ‘we need to have a LEO and a GEO antenna, and we’re going to go do this and that’ the question becomes: is there that next step that suddenly you could have two different providers on the same aircraft? Those are questions that no one would ever, ever talk about, but it’s happening everywhere else in the world except aviation,” noted Moeller.

“So, the question is — is that a bridge too far that will never happen, or is that day coming?”

And I think the answer is, it is, but it’s not today. But it is coming because what you’ve heard up here is airlines want the control back.

With multiple new IFC systems on the market, and many more coming down the pike — including solutions powered by Amazon’s Project Kuiper Ka-band LEO and Telesat’s Lightspeed Ka-band LEO — airlines and indeed all mobility players, have “an absolute wealth of options,” ST Engineering iDirect head of mobility business development Chris Insall noted on the panel at APEX TECH. “It’s a great time to be a customer in any mobility sector.”

A prominent aero modem manufacturer and satellite ground infrastructure provider, ST Engineering iDirect obviously observes low-latency LEO satcom being used for myriad applications in mobility, including on smaller aircraft. But in another example of why aviation in some instances mirrors maritime, especially when factoring in landing rights for certain countries, Insall said: “what we have seen is that the globally traded vessels are maintaining their GEO VSAT technology because they need to trade wherever it is, Venezuela, China, India, Vietnam, all kinds of places where they can’t depend upon having that LEO technology available all the time.”

And so, a cohesive blend and orchestration of multiple pipes addressing multiple orbits holds appeal in aviation.

Just as Quvia, formerly called Neuron, is a trusted partner in the cruise industry, it stands ready to aid airlines as they consider a similar pivot. When that does happen, said Moeller, Quvia Grid can be pressed into service to conduct the network orchestration

There may be other benefits as well. During AIX, Quvia VP, product and analytics Jonathan Kader told RGN that Quvia Grid has opened up new use cases and new revenue streams for cruise lines, “things that in telecommunications have been promised for ages, like network APIs being able to provision bandwidth for an emergency on call; or use latent capacity in the network to sync content to the edge or sync content back to the cloud in the middle of the night. All that stuff was again unheard of five years ago, three years ago, in cruise. We’re building products on top of Grid to solve those new use cases.” Some of the new applications will no doubt translate to aero.

IFC Revolution panel at APEX TECH from left to right: Moderator Mary Kirby of RGN, Quvia’s Mike Moeller; ThinKom Solutions’ Bill Milroy, ST Engineering iDirect’s Chris Insall, and JetBlue’s Ken McQuillan. Image: Airline Passenger Experience Association

Quvia already has a head start, having secured a bevy of high-profile airline customers for its powerful Pulse platform, a low-bandwidth QoE probe that provides real-time visibility of the connectivity performance and end-user QoE on each aircraft. With this real-time QoE data, airlines can grade all IFC providers equally across their fleet, address problem areas, and inform service level agreements (SLAs) including on a route-by-route basis.

So, whilst the current SLAs in aviation might cover all the flights on average over a month, Moeller said at APEX TECH, “What the airline wants to know is ‘tell me, from New York to LA on Monday morning, on my money route, what’s happening? What is the probability that that is going to be a good flight or a bad flight?’ Because that impacts their money routes. And so, what we’re seeing now is airlines being able to now dissect that data, pull it down and start looking at this and see what matters, and say, ‘these are the routes that are very important,’ and then to be able to work with their service provider to say, ‘these are the SLAs I like on certain routes, because these are the ones that are driving my revenue and my success as an airline.'” Publicly announced customers include Delta, but Quvia is also working behind the scenes with other high profile but as-yet-undisclosed airlines, as RGN learned during the conference.

Quvia has also inked an agreement with aero antenna-maker ThinKom Solutions which will see the two firms integrate ThinKom’s best-of-breed satcom antenna hardware with Quvia’s network management software to optimize QoE in commercial aviation. The resulting solution will combine ThinKom’s ThinAir Plus terminal with Quvia Grid.

ThinAir Plus pairs a ThinKom VICTS antenna with a LEO-only electronically steerable antenna to support virtually any service in any orbit relevant to aero, LEO, MEO, GEO and HEO. As mentioned, the physical architecture has been chosen by Hughes Network Systems for its Hughes Fusion product which will roll out on select Delta aircraft. And in that instance, Hughes acts as the single service provider, moving its high-capacity Ka-band GEO service over VICTS and Eutelsat OneWeb Ku-band LEO service over the Hughes LEO ESA, as a OneWeb distribution partner in aero.

Should airlines opt for two service providers on the same aircraft in the future, the Quvia and ThinKom partnership is especially well primed to support them. “We bring the hardware,” explained ThinKom chairman CTO Bill Milroy. “The good news is we brought so many different knobs to turn to bring that forward. The bad news is there’s so many knobs to turn, and certainly that’s not something you’d want the airline folks to have to do all by themselves, or flight attendants … You don’t want to do that in a binary way, like, ‘let’s use this system, and then let’s use this system.’ You want to harmonize the system, and that’s not something we do, but that’s something Quvia does very, very well.”

Related Articles:

- JetBlue observes fundamental change in passenger behavior

- VIDEO: Delta innovates with Hughes partnership, IFEC integration

- Will inflight connectivity market gravitate towards double-LEO hybrid?

Featured image of Starlink phased array antennas atop Hawaiian Airlins A321neo licensed from and credited to PaxEx.aero editor Seth Miller