Though Gilat Satellite Networks did not win the bid to provide Safran Passenger Innovations with the dual-beam, multi-orbit electronically steered antenna (ESA) for the Ku-band side of Airbus’ HBCplus program, the company nonetheless sees a strong opportunity in commercial aviation for its rival Ku dual-beam hardware, which is dubbed the ESR 2040.

During the Satellite 2024 conference and exhibition in Washington D.C., Runway Girl Network sat down with VP product and marketing Hagay Katz and VP of mobility & global accounts Amir Yafe for an extensive interview about the firm’s work in inflight connectivity.

Gilat faces competition in the multi-beam aero ESA market from a handful of other players. For instance, Hanwha Phasor this year plans to flight-test its multi-beam ESA and will use a Lufthansa Technik-built radome atop it; Stellar Blu Solutions recently assured it will bring multi-beam to the aero market with BAE Systems’ tiles; and CesiumAstro has said it is eyeing early 2025 for market entry of its own multi-beam kit.

Katz pointed out there are not many players that can do this sort of work. But when asked what Gilat sees as the addressable market for its ESR 2040, Katz told RGN candidly:

Well, as you know, Get SAT won some part of it; we want to take whatever is left.

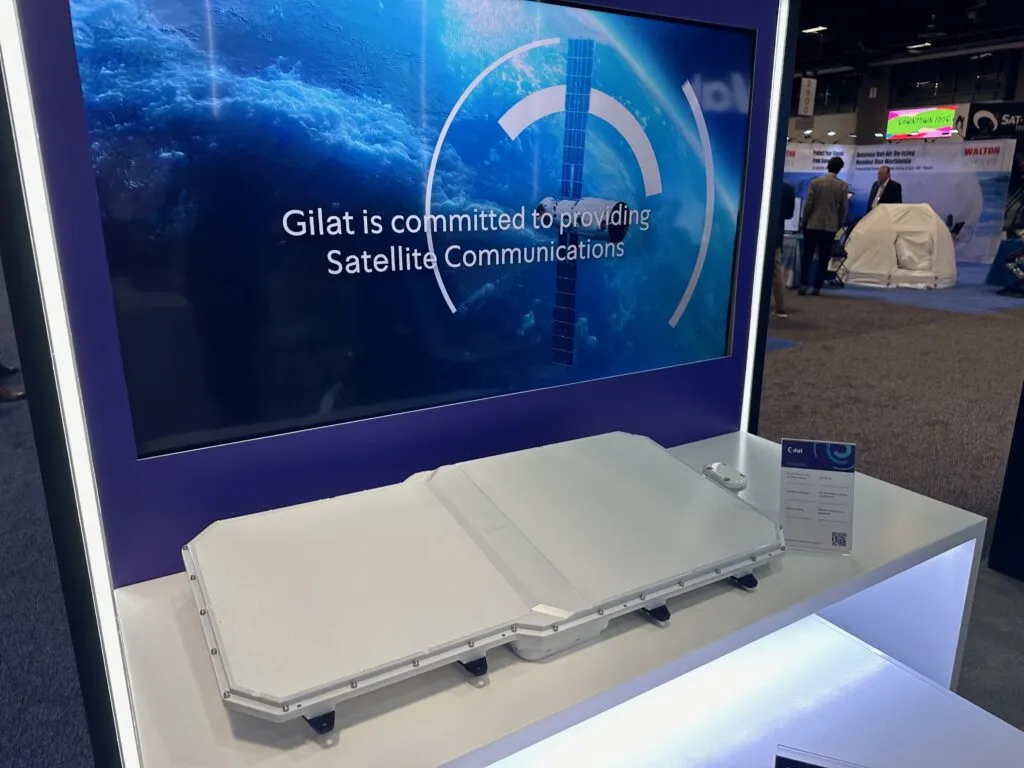

Gilat showcased its LEO-focused ESR 2030 hardware on stand at the show; the antenna has been developed for Satcom Direct’s OneWeb LEO program to support inflight connectivity in business aviation, government and defense.

The Israeli firm also showed a demo of ESR 2040, the Ku-band dual-beam kit that can provide simultaneous GEO plus LEO connections. It sees ESR 2040 as being a radome-free solution.

“We do not have yet any contract to publish; we are working on things, but you can see a demo of that, and we are checking the antenna right now as we speak. And we are getting good results. It’s the beginning of the tests, but we’re getting good results so far,” said Katz of the ESR 2040, which features two different arrays, one for transmit, one for receive.

“It is obviously bigger than the LEO antenna because it’s GEO plus LEO, but I think it’s quite an impressive antenna,” said Katz.

But aero ESAs are just a portion of Gilat’s broader portfolio. The company’s SkyEdge IV platform is a scalable, next-generation software-centric satcom ground system optimized for multi-orbit constellations and very high throughput satellites (VHTS); it has been selected by major satellite operators including Intelsat and SES with implications for IFC.

Gilat’s SkyEdge IV Taurus aero modem and prior-gen SkyEdge II-c modem, meanwhile, compete with modems on offer from Hughes Network Systems and ST Engineering iDirect. And Gilat recently announced another multimillion-dollar deal for Taurus in IFC. The company provides the modem and indeed other crucial parts to next-gen aero terminals.

We covered a lot of ground in the interview and so RGN is sharing the Q&A with readers.

RGN: A couple of years ago, Amir Yafe mentioned that this dual-beam antenna was intended for a variety of different aircraft. Is the ESR 2040 conducive for widebody aircraft as well or do you expect to start with the smaller airframes?

Katz: I think it’s more of a commercial rather than a technical issue. From a technical point of view, it definitely can do both. I think, as Amir explained at the time, it’s more about the business volumes that we see and the opportunity that will come.

RGN: Do you believe the first-generation aero ESA that we’re seeing, which are not dual-beam, will be quickly replaced by the dual-beam hardware that yourselves and Get SAT and others are bringing to the table?

Katz: So, as you may know, there are now RFIs for multi-beam. So, the direction is clear; I think all the industry wants to see a multi-beam antenna, dual-beam basically. As for the timing, that’s a different matter. The industry does not move very fast. It takes time. Multi-beam is very important, but there are other important things as well. So, as far as the timeline is concerned, it’s not really clear yet. I think the direction is there; we see RFIs coming, and several players are asking us about it. And we have the answers. I think the technology is there. But as I said, I don’t think things will be immediately replaced. Multi-beam will replace these single-beam antennas, but the question is when.

Yafe: I think the direction is for dual-beam. The question I think for us is, what is the timing for that? And it’s not just dual-beam. You want an antenna that does it with the right cost structure, the right performance. So, it’s bringing an antenna to market that is of value to the service providers.

RGN: Airbus had said, purely for example, that the Get SAT hardware is going to be available in 2026. Do you think Gilat will be able to offer its dual-beam antenna around the same timeframe? And are you looking to get into a linefit program with an airframer?

Yafe: If we were selected [for HBCplus], we would have brought that antenna on time. We have a demonstration unit; it does 80% of what is expected. We have not continued to productize it fully. So given that kind of the timeline, 2026; we would have probably met it if we had been selected a year ago.

We could deliver on time the antenna with dual beams with the current chipset technology, which is more or less what Get SAT has. We could deliver a better antenna with the new chips which is a later time, which will bring a better product. So, it all depends on when Gilat is being subcontracted for the antenna part. We’re not going to bring a product to the market and then try to sell it. We will work together with the end customer, with the supplier, to bring our technology to their terminal.

RGN: What are the key differentiators of Gilat’s aero ESA technology?

Katz: First, it is important to understand that there are not many players that can do this. Obviously after saying that, it’s about the quality of the antenna, the power, the size and so forth. Typically, as we do with Satcom Direct, we have a partner that works with us and we think that compared to others, we know how to deliver what the partner wants on time. That’s where our differentiation is. We want to do something where there is a partner that will work with us on that, and it will satisfy the problem.

Yafe: And just to complement, I think we can provide the best SWaP for the antenna, size, weight and power. And the second piece would be, I think Hagay mentioned, productization, manufacturing. We are a large-scale manufacturer of electronics. And that’s an area that we excel in quantities. So, we have the processes in place, the manufacturing line, the supply chain and what is needed to really produce antennas in large quantities and quality.

RGN: Obviously there’s excitement around OneWeb Ku-band LEO, and that it will become available hopefully this fall. But in the Ka-band, there’s Project Kuiper, there’s Teleset, there’s potentially Rivada down the road.

Yafe: So, on the Ka side, we continue to make progress and evaluating more technologies. And we participate in the RFP processes. So, like in the case of Satcom Direct, hopefully we will win one of those programs.

RGN: Where does aviation fit into the broader Gilat story?

Yafe: So, aviation is a big part of our platform. SkyEdge IV launched two years ago, and has multiple customers using that, including Intelsat, SES, and others. One of the key verticals for all of those satellite operators is aviation and inflight connectivity. So that’s one area that has been growing heavily. And then on the terminal side, the Taurus modem can be bundled with ESA for those customers interested in using that technology.

Katz: For the Taurus modems, maybe one out of five airplanes are equipped with that.

RGN: I did not know that. That is significant.

Katz: Roughly. And there are more than one out of five that are equipped with power amplifier from Wavestream. And we just published that we are expanding the Gilat Wavestream portfolio, for example there is new power supply that we do.

Katz: All in all, when you look at IFC, Gilat’s footprint is all over the place.

RGN: Now that we’re entering a multi-orbit reality, there is a lot of discussion about a software-defined modem. Are you guys working on that and what does that entail for you?

Katz: We definitely think that this is the trend. Again, it’s a matter of timing. Today we see in the market also solutions that are simply dual modems and they work. You don’t need to immediately go to the software-defined. Having said that, we think that the end result would be software defined. But you know, on the way, there will be solutions like dual modems.

RGN: Are you participating in the Seamless Air Alliance?

Yafe: Yes we are.

RGN: And what do you think about how they’re tracking in terms of their work towards a more standard modem, and then ultimately going software defined?

Yafe: Their direction is right. The technological challenge stems primarily from power limitations on the modman. So that that’s kind of an area where there’s still not clear technical solutions.

Katz: To do hardware that is doing several waveforms, that’s one thing, but to do it on let’s say a generic, commercial off the shelf, is another thing.

Yafe: Our modem is software-defined supporting multiple waveform for Gilat on the same modman, but to make it a generic platform, like an Intel platform for example or something similar, that’s where the power issue is. So, the direction is correct. I think the technology need to catch up and probably it’s a matter of time.

RGN: Very specific to the Satcom Direct LEO program that you’re working on, where does the modem sit in that terminal package, is that something that is within the aircraft itself?

Yafe: It’s outside the antenna. I think the split of antenna and modem, that’s the right architecture on any aircraft. You have a modman and it is separate from the antenna. It’s two LRUs system.

RGN: So, appreciating that the work with Satcom Direct is or business aviation; are there LEO-only kind of applications for commercial aviation in your view point?

Yafe: I think this is more a service concept. I think single-orbit, single-constellation is not probably the most robust solution for commercial aviation. I see the market go to a multi-orbit service. It doesn’t mean that it has to connect to both constellations at the same time; but there is an option to switch between constellations, between different types of satellite providers. So that’s creates an open system which is much more robust than just using a single supplier for a single constellation – all vertically integrated. Because any disruption in that ecosystem could create a service outage. You don’t have any other back-up any other alternative.

RGN: Some airlines have expressed an interest in a Holy Grail solution that would be multi-orbit, multi-band and ultimately supported by a software-defined modem and they want it to be low-cost of course, lightweight,

Yafe: I would support that.

RGN: Some airlines have also confided that they are a little bit worried about relying on just one satellite operator, and also there’s been some examples in the market recently, of course with the ViaSat 3 Americas satellite, being kind of a little bit of a wake-up call I think for even a number of the Viasat customers. That has been a pivotal moment in the market.

Yafe: I would support everything they said but realistically, at least next five to seven years, it will require two separate terminals – one for Ku and one for Ka. So with two antennas on the aircraft, airlines can sign up to GEO, LEO or MEO services on the Ka-band ecosystem and the same can be done with the Ku ecosystem. Full software-defined modem at the aircraft electronic equipment bay could also be desired but the technology is not available yet mainly due to ARINC power restrictions and the development costs porting waveforms to generic hardware. But one can foresee a hybrid approach of two to three modems to be able to support most GEO and non-GEO constellations. That’s not that far away, I think and could be achievable.

RGN: Is there anything else that you would like to highlight or underscore about your whether it be your antenna work or your modem work?

Katz: The airlines themselves, there are two things that they want at the same time. They want something very generic doing everything and so forth but, on the other hand, they want to go fast for ESA technology. And what it means at the end of the day is business. They are not going to wait ten years and then only then to get this thing that is multi-multi everything. They want something that is practical. And I think one of the differentiators that we have is that we know to find the golden path; we know to show them what we can do in a reasonable time and deliver things in a phased manner. This is something that I think we have that differentiates us from the others.

RGM: Hanwha Phasor, and Lufthansa Technik announced a cooperation where Lufthansa Technik is going to provide a radome for their ESA. Where do you sit in the radome for ESA discussion? Do you think that takes away some of the value of going with an ESA?

Yafe: So again, we are supplier of the antenna array and we would support definitely a radome-less solution; I think that’s the right direction. We need to see this in deployment in large numbers first, but I understand that extensive testing was done on the Stellar Blu antenna, so we know that a no-radome solution probably can work. So yes, I think the future is there in terms of reducing the height of the antenna over the aircraft without a radome.

RGN: So, you like the direction then that StellarBlu is taking.

Yafe: Yes, although again from Gilat’s perspective, we work with our partners to define that type of solution but yes, that’s something that we are researching to achieve.

RGN: Do you think gate-to-gate is an absolute must?

Yafe: We can achieve gate-to-gate without a satellite service connection all the time, or with a partial satellite service connection by utilizing 4G/5G cellular coverage and other type of connectivity available on the ground to achieve that.

RGN: Anything else you’d like to highlight about your talking points this week at Satellite?

Katz: Not directly related to IFC, we are unveiling the evolution path of the SkyEdge IV which is our next generation system. How to transform it also to the cloud and later on to 5G; there’s interest there. And I think our advantage is that we already deployed, GEO and MEO so we have an evolution, we call it ‘one leg in the ground’ given the certainty that they can still use what they invested in the current system and then go smoothly to a system that is virtualized and later on with 5G waveforms. And the SkyEdge IV, as you know, and SkyEdge II-c are backwards compatible so in terms of IFC for example they, the Taurus modem will live on between SkyEdge II-c and SkyEdge IV ops seamlessly.

RGN: So that’s a big selling point then.

Katz: Absolutely, this is one of the things that we are telling our customers. This is how we ensure that SkyEdge IV is giving all the advantages of the performance of the new type of modems and speed and everything, and scalability but then also supporting the airplanes with the Taurus.

RGN: Just on the modem front, your main competitors would be ST Engineering/iDirect?

Katz: STE and also HNS [Hughes Network Systems]; they are our two main competitors.

RGN: Do you see an opportunity to carve out a greater market share even than what you have right now?

Katz: We were the first one to launch the next-generation SkyEdge IV platform supporting multi-orbit and software-defined satellites. We had the advantage of being first in the market and we already sold it to SES and Intelsat, and Hispasat and I think, as I said, because of the compatibility with some of the modems with the previous SkyEdge II-c platform, that gives us advantage compared to the others.

Related Articles:

- ThinKom on unsticking airlines with a sticky multi-orbit antenna

- Hanwha Phasor sees 2025 market entry for constellation agnostic ESA

- Airbus successfully flight tests Get SAT antenna for HBCplus

- Kymeta eyes strategic partner in aero

- Delta, Hughes tout Jupiter connectivity following CRJ200 flight tests

- Viasat still determining NGSO ambition and its pertinence to IFC plan

- Eutelsat OneWeb to support inflight connectivity from September 2024

- Telesat on why the wait for Lightspeed will be worth it in aero

- OneWeb-powered Galileo to be competitively priced to Starlink: Gogo

- Stellar Blu to develop multi-orbit, multi-beam aero ESA with BAE tiles

- Intelsat touts global ESA capabilities following historic flight tests

Featured image of Gilat LEO-focused ESA for Satcom Direct bizjet program credited to Mary Kirby