Telesat expects to start supporting global Lightspeed Ka-band Low Earth Orbit (LEO) satellite-powered broadband connectivity in the aviation market — and all its target markets — in the fourth quarter of 2027.

The Canadian satellite operator is certainly arriving a little later to the low-latency LEO game than others, including the market’s existing players, SpaceX Starlink and Eutelsat OneWeb. But it believes Lightspeed’s key differentiators will resonate with airlines. Indeed, they already are.

Amid a rapidly changing IFC landscape that sees airlines in some instances adopt shorter contracts, eschew traditional antenna equipage standards, and show a greater appetite for rip-and-replace programs than observed in the past, Telesat is presently immersed in Critical Design Reviews for the Lightspeed network, and has already completed some CDRs.

In December 2026, it will launch an initial cluster of pathfinder satellites on a SpaceX Falcon 9 rocket before moving into a “quick cadence” of Lightspeed LEO satellite launches throughout 2027, Telesat vice president, aviation Philippe Schleret confirmed during the APEX TECH conference in Los Angeles, as part of a session moderated by your author titled ‘The latest in IFC: is LEO going to eat everyone’s lunch?”

Even before Telesat launches its first few pathfinder satellites, it will have already conducted “extensive tests” on the ground and “it will be really a matter of confirming what we’ve tested on the ground.” Schleret said.

Falcon 9 launches of Lightspeed LEO satellites will continue throughout 2027, enabling Telesat, by the end of next year, to offer what Schleret describes as a “comprehensive” service that will be “global from day one” — even before the entirety of the 198-satellite constellation has been built out.

At the mic, Telesat vice president, aviation Philippe Schleret, center, is flanked to his right by Viasat’s vice president of global aviation partners and service delivery, Brian Simone, and to his left by ThinKom Solutions chairman and CTO Bill Milroy. RGN editor Mary Kirby served as moderator.

Telesat has long pursued a B2B approach in aviation and other verticals. For instance, it helps to power Panasonic Avionics’ Ku-band geostationary (GEO) satellite-based IFC service. It will retain this partnership model for Lightspeed.

The firm’s aviation channel partners can in fact avail of a Lightspeed network emulator today, enabling them to “already start the full integration, end-to-end of the service in their labs so that once we go to field trial, it’s a matter of validating that what they’ve integrated and tested, they’re seeing the same with the constellation,” Schleret said. “That way, they are fully ready to make use of the constellation on Day 1 and deliver services.”

Telesat has designed Lightspeed specifically for enterprise-grade applications. Services will be delivered with guaranteed service level agreements (SLAs) rather than best-effort.

And, unlike SpaceX Starlink or the forthcoming Amazon LEO service, Lightspeed will not serve the residential market.

Said Schleret:

One of the requirements that we took from the inflight connectivity [market], is the ability to focus capacity where it’s needed, when it’s needed. And, you know, airport hubs are obviously a very important part of it.

So we do beam hopping, which means if it’s in the middle of the Pacific Ocean and an aircraft is just passing by, we just bring the amount of capacity that the aircraft needs. If it’s over the New York area or New Delhi, Atlanta or Dallas, then we can focus capacity full time, coming from multiple satellites to maximize the amount of capacity that’s needed to serve hundreds of aircraft converging around these airport hubs.

Even as SpaceX proves to be a disruptive force in IFC with Starlink and its direct approach to the market, Telesat sees continued benefits to the B2B model because it believes a superior passenger experience can be achieved in a variety of different ways. Moreover, no airline is the same; they all value different things and multiple channel partners can support that level of diversity.

While the passenger experience “has proven that having a LEO component in any case is critical,” Schleret stressed about the march of LEO in aviation, Lightspeed can power LEO-only IFC or multi-network solutions, and the latter can be multi-LEO (think Lightspeed paired with Amazon LEO, purely for instance) or multi-orbit, such as LEO/GEO.

On this front, Telesat shares a similar view to Eutelsat OneWeb, which has also taken a B2B approach to the market and is supporting Ku-band LEO-only and multi-orbit IFC via partners.

Resiliency: inherent to Lightspeed and also supported by multi-network

By nature of its design, Telesat Lightspeed boasts some inherent resiliency, however. Each MDA Space-made satellite has four 10 Gbps optical inter-satellite links (OISLs) that interconnect the constellation with laser communications, forming a global mesh network in space. With four data routing paths on each satellite and the ability to “skip over” a satellite to the next one in the event of a satellite anomaly in the network, Telesat sees Lightspeed as “a self-healing network that assures data is delivered to its final destination.”

A multi-network approach including for inflight connectivity “adds another layer of resiliency and some airlines value that,” Schleret said at APEX TECH, noting “that’s something you see on the ground in enterprise networks.” IFC resiliency is also greatly valued in government and the military.

As a residential customer of Starlink, who uses the LEO satellite-powered Internet service for both business and entertainment, I understand the benefit of having a second pipe as I am accustomed to switching to the Verizon network whenever I encounter an issue with Starlink.

Being able to offer resiliency is important to satellite operator and aero ISP Viasat as well. That’s among the reasons why the Carlsbad, California-based company has already inked a Lightspeed services agreement with Telesat to power its Amara-branded inflight connectivity — a multi-orbit solution that combines Viasat’s high-capacity GEO satcom service with Lightspeed LEO for airlines.

“[H]aving the combination of a GEO asset and a LEO asset gives you the ability to have the best performance. So now we can leverage both things. We can route traffic intelligently through the different channels. It also gives us an immense amount of resiliency,” explained Viasat vice president of global aviation partners and service delivery Brian Simone. “[Y]ou yourself are doing a manual SD WAN [software-defined wide area network] switch in order to be able to make sure you stay connected. And so we all see it now, right?”

Emphasizing the value of resiliency, Bill Milroy, who serves as chairman and CTO of multi-orbit antenna-maker ThinKom Solutions asked the rhetorical question: “Can GEO satellites have a problem once they get up to orbit or after they’re in orbit? Yes. Could a well known constellation have a four-hour worldwide, global outage? Yeah, that could happen. Could it be a cyber attack on one of these? Yeah.”

For Viasat, whose aviation clientele spans the globe, there are also geographical and geopolitical drivers behind its particular pursuit of multi-orbit IFC, including the need to ensure IFC works over the poles and that aircraft can stay connected when they overfly China, which requires regulatory approvals and partnerships with Chinese satcom players. “All of those things matter,” Simone said.

Agnostic approach to antenna hardware

Other IFC stakeholders are poised to tap Telesat for Lightspeed LEO service. That’s because Telesat has taken an agnostic approach to the market and is willing to support a variety of different terminals, from electronically steerable antennas — whether LEO-only, multi-LEO or multi-orbit — to ThinKom Solutions’ multi-orbit Ka2517 VICTS mechanically-steered phased array hardware to gimbaled antennas like Viasat’s existing Lightspeed-compatible GM-40, as well as its forthcoming next-gen AERA dual-beam multi-orbit ESA.

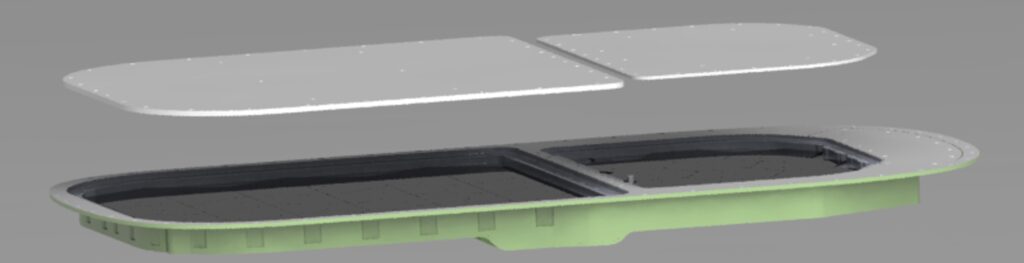

This image is the current representation of AERA, the dual-beam electronically steerable antenna from Viasat. The final design is subject to change. Image: Viasat

This terminal flexibility is a differentiator for Telesat, with Schleret noting that the Viasat GM-40 is already widely deployed on thousands of aircraft — such as at American Airlines, Delta Air Lines, JetBlue and KLM — and that the ThinKom Ka2517 is rolling off the line as supplier-furnished equipment at Airbus and buyer furnished equipment at Boeing. According to ThinKom’s Milroy, roughy 1,500 aircraft are presently fitted with Ka2517. Airlines carrying the GM-40 or Ka2517 will have the choice to add a LEO component when Lightspeed services are on line.

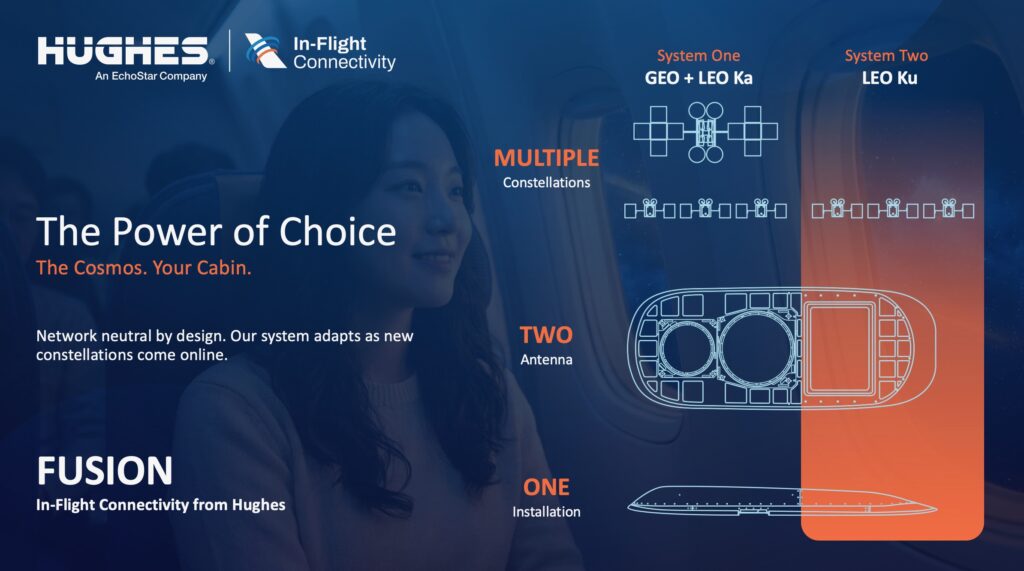

Delta is also gearing up to fit its Boeing 717s and select Airbus A321neos and A350-1000s with Hughes Network Systems’ Fusion product, a multi-network, multi-orbit, multi-beam, multi-band offering that pairs Hughes’ LEO-only ESA — talking to Eutelsat OneWeb’s Ku-band LEO service — with Ka2517, which talks to GEO but is also compatible with Lightspeed. Latency-sensitive applications can be sent via LEO whilst less sensitive apps route via GEO.

In the future, Delta and Hughes’ other unannounced Fusion customers could ostensibly enable IFC via two LEO networks plus GEO by utilizing the LEO-only ESA for OneWeb while allowing Lightspeed LEO and GEO satcom to be ferried over Ka2517.

Hughes Fusion is an industry-first multi-beam and multi-band solution with two independent systems engineered as one. Image: Hughes

The advantage to having “existing field proven antennas that are compatible with Lightspeed and then can either switch to Lightspeed or Lightspeed be added [to support multi-orbit] when we are in service” presents an “obvious” advantage, Schleret said.

“We already see that today, our channel [partners] are already in the fields, proposing and winning fleets with those solutions,” he continued. “So that’s for the existing antennas. And then, in parallel, our channel partners are developing Ka-band ESA antennas, and they’re working with us so that will type approve those antennas.”

Some Lightspeed compatible terminals support speeds in excess of one Gbps.

Telesat has contracted for 14 Falcon 9 launches to build out its 198-satellite Lightspeed constellation. Though it’s coming later to the party than other LEO operators, its arrival remains hotly anticipated in aviation.

Related Articles:

- Riyadh Air selects NSG to provide IFC on A321neo twinjets

- KLM offers Viasat-powered free Wi-Fi on European flights

- Immfly targets budget airlines with OneWeb LEO IFC, Gogo antenna

- SES flags risk when airlines ‘hand over the keys’ to Starlink

- Lufthansa hands massive fleet-wide IFC contract to Starlink

- SES targets thousands of tails for IFC partnership model

- Qatar Airways becomes first in the world to bring Starlink to 787s

Featured image credited to Telesat. First embedded image credited to the Airline Passenger Experience Association (APEX)