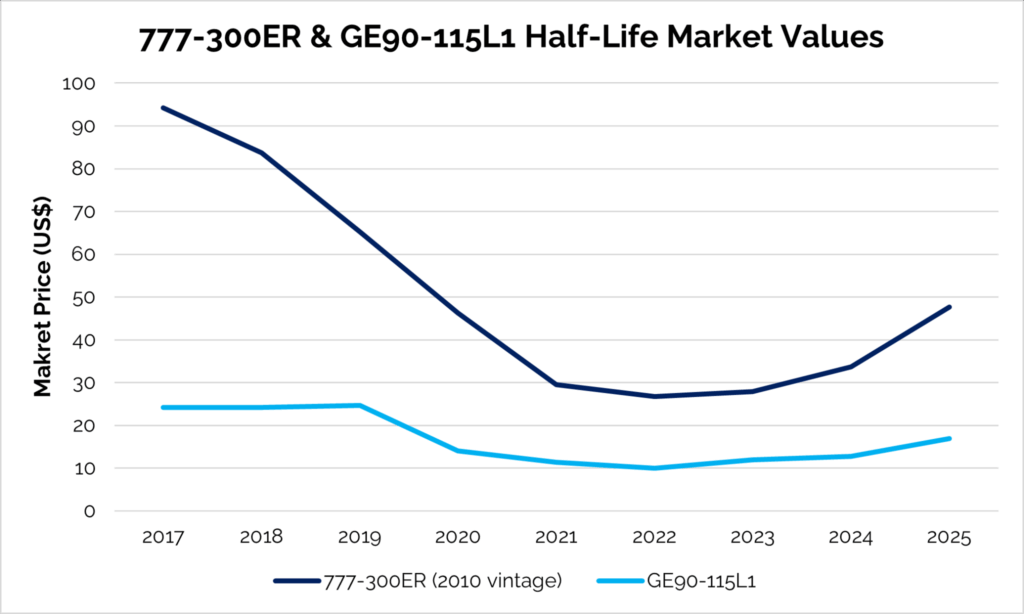

IBA, the award-winning aviation market intelligence and advisory company, reports that half-life market values for the Boeing 777-300ER have jumped 78% in 2025 to about US$ 47.6m, up from the lows of circa US$ 26.7m recorded in 2022 for a 2010 vintage.

IBA, the award-winning aviation market intelligence and advisory company, reports that half-life market values for the Boeing 777-300ER have jumped 78% in 2025 to about US$ 47.6m, up from the lows of circa US$ 26.7m recorded in 2022 for a 2010 vintage.

According to IBA’s latest analysis, this rise is primarily driven by ongoing delays to Boeing’s 777X programme and limited production of Airbus’ competing A350-1000 model, sustaining demand for previous-generation widebody aircraft and extending the operational life of the 777-300ER fleet.

As a result, associated engine values have also strengthened. Market values for green time GE90-115B engines have risen 69%, increasing from around US$ 10m in 2022 to approximately US$ 16.9m in 2025, reflecting the increased demand for maintenance, repair, and overhaul (MRO) services as aircraft remain in service longer than originally anticipated.

Image: IBA Insight

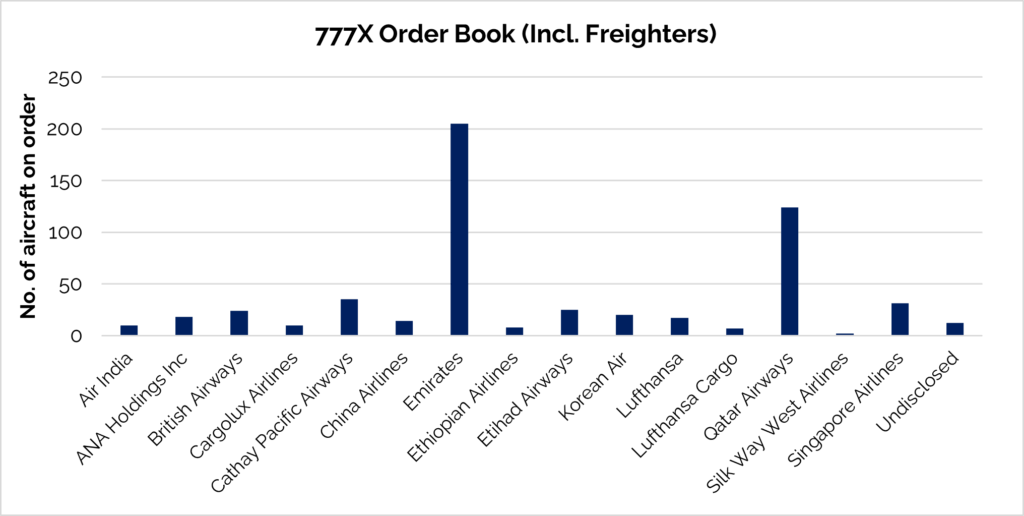

IBA reports that while Airbus has benefited from the 777X’s continued delays, with its A350-1000 currently the only new-generation large widebody aircraft in production, Boeing retains a strong order book for the 777X.

Intelligence from IBA indicates that Boeing currently holds 503 orders for 777X passenger aircraft, while Airbus has 103 A350-1000s in service and a further 258 on order. Once certification and deliveries of the 777X commence, IBA expects production rates to stabilise and market confidence to grow, potentially leading to additional orders.

Image: IBA Insight

IBA notes that no 777X orders have yet been placed by US carriers, likely reflecting the relatively young age of existing 777-300ER fleets at American Airlines and United Airlines, which both average under ten years. As these fleets mature, IBA anticipates new replacement orders may be placed, while Air Canada, operating a combined fleet of 25 777-300ER and 777-200LR aircraft with an average age of around 16 years, could also consider the 777X as a future replacement candidate.

IBA predicts that values for previous generation widebody aircraft will remain elevated in the short term due to constrained supply. However, with the 777X’s certification and entry into service on the horizon and OEM production rates increasing, market conditions are expected to normalise gradually.

To read IBA’s analysis in full, click here.

About IBA

IBA delivers the best of all worlds – deep aviation consultancy expertise and cutting-edge, actionable data insights, all delivered by a proven, expert team with a strong customer focus.

An independent, innovative and forward-thinking business, IBA has over 35 years of heritage and experience in aviation. Having won the Sustainable Technology award for its IBA NetZero platform in 2024 & 2023 and for its Carbon Emissions Calculator in 2022 and being named ‘Appraiser of the Year’ by its clients for five years, IBA prides itself on its integrity, fierce independence, and continual innovation.

The key to IBA’s success is its people – some of the best in the industry, based in multiple locations across the globe – real experts who are passionate about aviation and go the extra mile for their clients.

Featured image credited to Jason Rabinowitz