Panasonic Avionics is in talks with Airbus about a possible “interim solution” for the Ku-band side of the airframer’s linefit, supplier-furnished HBCplus inflight connectivity program, whilst Airbus hones its multi-beam electronically steered antenna (ESA) terminal strategy with an eye on delivering against a delayed timeline of 2027.

“We are actively working with Airbus on the evolution of Ku HBCplus. It’s obviously a little disappointing that there’s a gap, but we are talking to them about what an interim solution might look like,” Panasonic Avionics vice president, connectivity business unit John Wade revealed to RGN at the Aircraft Interiors Expo in Hamburg.

“But there’s not a lot we can say about that until we and Airbus have aligned around that.” They are hopeful of a near-term announcement.

SPI weighs in

During Airbus’ press briefing at AIX, head of connected aircraft Tim Sommer said the OEM believes it can come up with an even more flexible, modular, lighter and simpler Ku HBCplus terminal solution than shown last year, whilst still moving forward with the Thales/Get SAT dual-beam ESA architecture for 2027 linefit installs. This followed his pre-show revelation to RGN that “a combination for example of a LEO with something which is maybe LEO/GEO, but maybe in an architecture which is a bit simpler and a bit lighter in terms of footprint and maybe also in terms of integration on the aircraft” holds appeal for Airbus.

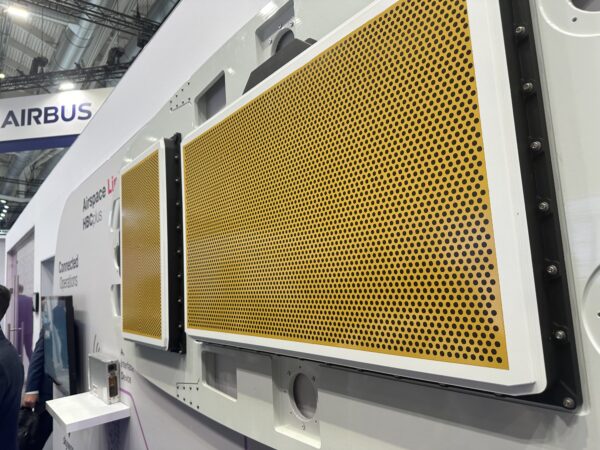

But in contrast to last year’s show, neither Airbus nor its HBCplus terminal provider, Safran Passenger Innovations (SPI), displayed the Thales/Get SAT dual-beam ESA on their stands. SPI’s already-in-revenue-service Ka terminal for the program, which is based on ThinKom Solutions’ Ka2517 VICTS hardware, was prominently displayed at both.

“In terms of the Ku side, we’re still partnering with Airbus to provide terminal solutions,” SPI vice president of products and strategy Ben Asmar confirmed to RGN. “They are looking and evaluating their options based on what’s happening in the market…

“So, they want to be able to support different Ku options that are out there, so now they’re just trying to determine what is the best one. And there’s very good options out there. The Get SAT technology I think is still excellent.”

But he admitted that the ultimate configuration “may not be exactly what we talked about last time“.

At AIX 2024, both Airbus and SPI showcased a Thales/Get SAT dual-beam ESA architecture for the Ku-and side of HBCplus. Neither displayed the kit at AIX 2025.

Panasonic and Intelsat are of course using the Gilat/Stellar Blu Sidewinder single-beam ESA for their nextgen IFC retrofit and Boeing linefit projects to support IFC via Eutelsat OneWeb LEO and their respective GEO networks. And Gilat has expressed optimism that Airbus will see fit to adopt its Stellar Blu Sidewinder ESA, which is now supporting the free Wi-Fi model on Air Canada’s CRJ900s, and rolling out on American Airlines’ E175s.

Asked by RGN at AIX to share his impressions of the Gilat/Stellar Blu Sidewinder ESA, SPI’s Asmar said: “I think single beam is going to obviously provide good service on the networks they’re on today. I think it comes back to the question, if we look at what the Delta experience is, where they see value in multi-beam, I think you have to question, well maybe what is the next generation coming? And I know they have talked about going multi-beam for their next generation as well. So obviously they’re thinking about it. So, they can see value in the market. The question is can they get to market fast enough to kind of grab some of the market share. Because we’ve seen how quickly Starlink were able to do that.”

As of 8 April, Intelsat had secured multi-orbit IFC commitments covering 1,000 aircraft, based on Sidewinder. For its part, Panasonic announced Discover Airlines as a multi-orbit IFC launch customer at the show, but Wade said the firm has secured two other undisclosed operators that will start installs before Discover.

Regarding Panasonic’s talks with Airbus over an interim solution for Ku HBCplus, Wade said: “It would be premature to say anything right now, but I think Airbus recognizes there’s a huge amount of interest in OneWeb and LEO and are doing their best to respond to customer demand.”

It is perhaps notable that Panasonic’s relationship with Airbus has evolved in a positive direction. Panasonic has, for instance, separately inked a MOU with Airbus that, when finalized, will see Panasonic’s powerful Converix hosting platform leveraged to help Airbus realize its fuller strategy for connected aircraft.

Airbus has said it isn’t interested in expanding its Buyer Furnished Equipment (BFE) catalogue for IFC. But the airframer did reach a one-time agreement with an undisclosed airline to deliver Ka-band HBCplus as BFE. One wonders if it would be willing to make an exception for would-be nextgen Ku-band IFC customers that want a linefit solution before 2027.

Related Articles:

- Panasonic poised to play key role in Airbus connected aircraft

- Blazing fast Internet on an RJ? Air Canada stuns in free Wi-Fi rollout

- Viasat details Amara nextgen inflight connectivity strategy

- Airbus adds Amazon, confirms Hughes, removes Viasat from HBCplus

- Airbus fine-tunes HBCplus Ku-band in advance of AIX 2025

- Gilat optimistic about securing Airbus linefit for Stellar Blu ESA

- Intelsat multi-orbit IFC showdown: AC CRJ900 versus AA E175

Featured image credited to and copyright of Airbus