ViaSat’s overall fiscal first quarter results were positive, with company-wide revenues up 8% over the same period last year, but management’s admission that ViaSat is somewhat hampered in growing its consumer-on-the-ground business due to capacity constraints begs the obvious question of whether commercial aviation will find itself in a similar crunch, and if so, which side of the business will ViaSat favor in the end?

Reading between the lines of the details divulged during ViaSat’s recent earnings conference call, and after speaking with ViaSat director Don Buchman, it seems clear that the aero business will be protected at all costs, and is ultimately expected to grow to become the more valuable of the two.

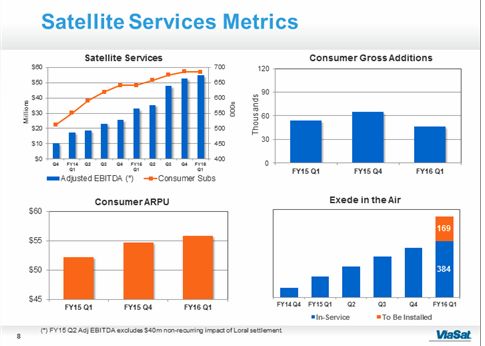

But let’s address that capacity issue first. Even though ViaSat-1 holds the Guinness record for being the highest capacity communications satellite in the world, like every satellite it has a finite amount of capacity. ViaSat saw what management described as “essentially flat” growth on the consumer side after shedding 1,000 subs in the “seasonally challenging” first quarter. But the company continued to increase the proportion of higher value and retail subscribers leading ARPU [average revenue per user] to reach a new record of $55.75. And it returned to net positive sub growth in June.

Though ViaSat never speaks specifically about individual spot beams – noting only that “the beams don’t sell evenly; every beam doesn’t have the exact same ramp rate” – there are some hot spots, if you will, where the company must be extra diligent in managing its inventory – especially for residential subs – by not oversubscribing capacity. That means that ViaSat can stop selling in certain areas where bandwidth could potentially become short. When combined with natural churn, sub numbers can decrease as they did in the fiscal first quarter. However, it’s probably important to note that the decrease of 1,000 subs represents well under 1%.

“We think we’d be destroying value if we stuffed too many customers into limited pools of bandwidth in the interim to show some arbitrary increase in net subscribers. That’s especially true when we can obtain equal or better financial results with higher customer satisfaction by having fewer customers on higher value service plans,” says ViaSat CEO Mark Dankberg.

Buchman adds, “It’s important for us to live up to the quality we’ve [promised]. It’s all about planning; we’re managing demand against supply.”

In order for the company to assess and “groom” bandwidth availability on the consumer side, it needs to know well in advance exactly what is required in terms capacity for its airline clients. “The next 18- to 24 months, we know clearly how many installs, how many airplanes, and the flight timetables [of our customers] so we can plan in our stats and demand,” Buchman tells RGN.” It’s [about asking ourselves] how much inventory do I have for residential; I’ve already carved out what I want to sell for airlines…”

By not oversubscribing on the consumer side, ViaSat can also be assured that it has the capacity to support JetBlue’s forthcoming Amazon Prime video streaming arrangement, which could see the airline require more bandwidth. Noting that streaming video “is the acid test” for inflight connectivity, Dankberg says ViaSat wants to make sure the company is ready to “scale up” to support an arrangement that will prove more lucrative in the long term.

Perhaps an imperfect analogy will help. Let’s say you’ve got a lemonade stand. For Saturday, you have only one glass left. Someone rides by on a bike, but you see a bus on the horizon. Who is probably going to pay more for your leftover unit of capacity, errr, lemonade? The bus.

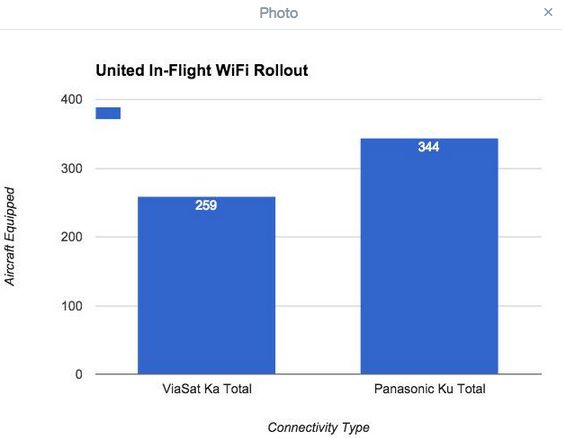

ViaSat is, of course, currently supporting three airline programs in the United States – the rollout of Ka on JetBlue’s Airbus A320 and Embraer E-Jets fleets (the A320 installs are all but complete), the rollout of Ka on the Continental portion of United’s domestic mainline fleet, and the rollout of Ka – and ultimately hybrid Ka/Ku – on 10 new Airbus narrowbodies at Virgin America (the carrier launched service on its first equipped aircraft last week). While ViaSat is lead on the Virgin America contract, it doesn’t enjoy that status at JetBlue and United. There, supplemental type certificate (STC) holder Thales is lead.

On the international front, ViaSat has its fingers in other pots. In addition to its own direct contract with El Al (Ka connectivity – and the rumor of a possible TV antenna under the hump down the road), ViaSat is a supplier to contract lead Thales on the Vueling contract. The low-cost carrier will launch Ka connectivity on its A320s – using Eutelsat’s high-capacity KA-SAT satellite – when Spain gives the all-clear. The Spanish air safety agency AESA has been slow to green-light the Vueling connectivity launch. Thales is cautiously optimistic it will happen in the near-term, and that the service will be akin to the high-speed service offered on JetBlue and United.

Thales was also thought to have had the Aer Lingus A320 connectivity contract in the bag – LiveTV secured the business a few years ago with an eye to a 2014 launch – but RGN can confirm that IAG’s planned acquisition of Aer Lingus has effectively stopped this program, and there is no guarantee the business will be won by Thales/LiveTV.

ViaSat was slated to be a “Surfbream technology” supplier to the Aer Lingus program in addition to Vueling (and is working with Eutelsat to try to stitch together regional services for a global footprint). There could be an opportunity for ViaSat to bid direct on the Aer Lingus business once the IAG deal is done. Incidentally, Aer Lingus carries Panasonic’s Ku connectivity system on its Airbus A330s.

Buchman declined to comment on any contractual arrangements with Vueling, and on the potential for winning a direct deal with Aer Lingus, noting only, “In general, we’re obviously pursuing the marketplace through partners and directly when it makes sense. As each opportunity rises we make that decision.” Aer Lingus could not be reached for comment.

So how do ViaSat’s regional Ka installs on commercial aircraft stack up against Ku installs by rivals Panasonic Avionics, Global Eagle and Gogo? We now have firmer visibility into the numbers, with ViaSat reporting 384 installs at the end of the fiscal first quarter, Panasonic reporting last month that it hit its 800th install, Global Eagle confirming 675 installs, and Gogo telling RGN it has 150 installs of traditional Ku (inclusive of the JAL and Delta contracts) – a product it is already referring to as legacy. All of these numbers will have since moved to the right. Gogo also has a backlog of 500+ for its nextgen 2Ku, which is now being tested on its 737-500 flying testbed.

Featured image credited to istock.com/ozgurdonmaz